Attached files

Table of Contents

As filed with the Securities and Exchange Commission on October 22, 2009

Registration No. 333-161719

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

AMENDMENT NO. 2 TO FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GLOBAL DEFENSE TECHNOLOGY & SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 8711 | 20-4477465 | ||

| (State or other jurisdiction of incorporation or organization |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1501 Farm Credit Drive, Suite 2300

McLean, Virginia 22102-5011

(703) 738-2840

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John Hillen

Chief Executive Officer

Global Defense Technology & Systems, Inc.

1501 Farm Credit Drive, Suite 2300

McLean, Virginia 22102-5011

(703) 738-2840

(Name, address including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jeffrey B. Grill, Esq. | Craig E. Chason, Esq. | Christopher C. Paci, Esq. | ||

| Pillsbury Winthrop Shaw Pittman LLP | Pillsbury Winthrop Shaw Pittman LLP | Jack I. Kantrowitz, Esq. | ||

| 2300 N Street, NW | 1650 Tysons Boulevard | DLA Piper LLP (US) | ||

| Washington, DC 20037 | McLean, VA 22102 | 1251 Avenue of the Americas | ||

| (202) 663-8000 | (703) 770-7900 | New York, NY 10020 | ||

| (212) 335-4500 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the Securities Act) check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

| Non-accelerated filer x (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission (the SEC), acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PROSPECTUS (Subject to Completion) | Dated October , 2009 |

[—] Shares

Common Stock

This is an initial public offering of shares of our common stock. We are offering [—] shares and the selling stockholders are offering [—] shares of our common stock. We will not receive any proceeds from the sale of shares by the selling stockholders. Prior to this offering, there has been no public market for our common stock. We have applied to list our common stock on the Nasdaq Global Market under the symbol “GTEC.” We expect that the public offering price will be between $[—] and $[—] per share.

Our business and an investment in our common stock involve significant risks. These risks are described under the caption “Risk Factors” beginning on page 13 of this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||

| Public offering price |

$[—] | $[—] | ||

| Underwriting discount |

$[—] | $[—] | ||

| Proceeds, before expenses, to Global Defense Technology & Systems, Inc. |

$[—] | $[—] | ||

| Proceeds, before expenses, to the selling stockholders |

$[—] | $[—] |

The underwriters may also purchase up to an additional [—] shares from one of the selling stockholders at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments.

The underwriters expect to deliver the shares against payment on [—], 2009.

Cowen and Company

[— ], 2009

Table of Contents

You should rely only on the information contained in this prospectus. We have not, and the selling stockholders and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the selling stockholders and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

We own pending U.S. trademark applications for the following marks: WatchIT™ and ResourceNet™. In addition, we license the GLOBAL™ mark from our indirect parent, GLOBAL.

i

Table of Contents

This summary provides an overview of selected information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our common stock. You should carefully read the prospectus and the registration statement of which this prospectus is a part in their entirety before investing in our common stock, including the information discussed under “Risk Factors” beginning on page 13 and our consolidated financial statements and notes thereto that appear elsewhere in this prospectus. See “Relevant Industry Terms” beginning on page 114 for a more complete definition of industry terms used in this prospectus.

Except as otherwise indicated, or as the context otherwise requires, the “Company,” “GLOBAL Defense Technology,” “we,” “us,” and “our” refer to Global Defense Technology & Systems, Inc., a Delaware corporation, and, where appropriate, its direct and indirect subsidiaries, Global Strategies Group Holding (North America) Inc., which we refer to as GNA Holding, Global Strategies Group (North America) Inc., our operating company, which we refer to as GNA, and The Analysis Corp., which we refer to as TAC. Unless otherwise stated, information in this prospectus assumes that the underwriters will not exercise their overallotment option.

Our Company

We provide mission-critical technology-based systems, solutions, and services for national security agencies and programs of the U.S. government. Our services and solutions are integral parts of mission-critical programs run by the Department of Defense, Intelligence Community, Department of Homeland Security, federal law enforcement agencies, and other parts of the federal government charged with national security responsibilities. The programs that we support are generally funded as part of the budgets and spending levels of U.S. government agencies entrusted with carrying out the U.S. government’s defense, intelligence, and homeland security missions.

Our primary areas of expertise include:

| • | counter-terrorism intelligence and analysis |

| • | data analysis and intelligence fusion tools |

| • | force mobility, modernization, and survivability solutions |

| • | maritime domain awareness and navigation systems |

| • | systems and software engineering |

| • | network and communications management; and |

| • | decision support systems for command and control. |

We conduct our business through two reportable segments: Technology and Intelligence Services, or TIS, and Force Mobility and Modernization Systems, or FMMS. Through our TIS segment we provide a broad range of technology-based services and solutions, including counter-terrorism and intelligence solutions and command, control and decision support solutions to customers in the Department of Defense, the Intelligence Community and other U.S. agencies. Our TIS segment is comprised of the operations of TAC and our Global Mission Systems, or GMS, division. Through our FMMS segment we provide customers, primarily in the Department of Defense, with solutions that entail the design, engineering and integration of highly mobile mission support systems. Our FMMS segment is comprised of the operations of our Global Defense Engineering, or GDE, division.

In 2008, we derived substantially all of our revenue from national security customers. Approximately 74% of our revenue was derived from the Department of Defense, including the U.S. Army, U.S. Navy, U.S. Marine Corps, National Guard, and Department of Defense agencies within the Intelligence Community, and approximately 26% of our revenue was derived from national agencies including the Department of Homeland Security, federal law enforcement agencies, and other agencies in the Intelligence Community. For the six months ended June 30, 2009, our revenue was $103.0 million, representing organic growth of 10.6% over the same period in 2008.

1

Table of Contents

Our Market Opportunity

The Department of Defense represents the largest component of the U.S. government’s discretionary spending, accounting for approximately 19.5% of total requested fiscal year 2010 budget authority. For fiscal year 2010, the Obama administration has submitted a base defense budget of $534 billion (an increase of $20.5 billion from fiscal year 2009) and an additional $130 billion for overseas contingency operations, primarily in Iraq and Afghanistan, for a total of $664 billion. In addition, Congress has passed a supplemental appropriations bill including $95 billion in Department of Defense, Department of State and international assistance funding predominantly related to Iraq and Afghanistan for the remainder of fiscal year 2009. While defense and intelligence spending have grown tremendously since September 11, 2001, there has also been realignment in the strategic priorities of the U.S. national security community. With the change in national security focus from conventional state-on-state conflicts (such as Operation Desert Storm) to counter-terrorism, stability in fragile but strategic regions, counterinsurgency warfare, and other forms of irregular or expeditionary warfare, there has been a concomitant shift in defense and intelligence investment.

Even before the submission of the fiscal year 2010 defense budget and Defense Secretary Robert Gates’ articulation of the “Balanced Strategy” behind it, the Obama administration and Congress clearly signaled their intent to intensify the U.S. government’s focus on addressing post-Cold War national security challenges, new intelligence missions and systems, the use of “soft power” to stabilize post-conflict in fragile but strategic areas, and homeland security. This perspective, and the programmatic and budgetary decisions that are emerging, make for a strategic landscape that we believe presents us with a significant market opportunity.

We believe the following trends and developments will drive continued growth in our target markets:

| • | Robust Funding for Intelligence and Counter-Terrorism Programs. Counter-terrorism efforts both at home and abroad are likely to remain a central focus of the U.S. government and the Obama administration. In the military, intelligence, and homeland security/law enforcement communities, programs that create expertise, systems, and solutions for the ever-evolving threat of terrorism are a top priority. |

| • | A Continued Drive Toward Force Mobility and Modernization in all the Services. Over the past 15 years, and more recently for theaters such as Iraq, Afghanistan, Africa, Southeast Asia and elsewhere, the military services have had to design new systems to support expeditionary forces to be deployed quickly to remote areas with little or no infrastructure for the delivery of power, water and other essential services. We expect that the requirement to support worldwide force mobility and modernization for U.S. forces will remain a priority for the Department of Defense and other national security agencies. |

| • | Emphasis on Enhancing the Information Advantage in Warfare. While funding for expensive weapons platforms – tanks, ships and planes – may be at risk in the future, we believe that the military and intelligence funding to create a proprietary information network of digitally linked sensors, data processors and decision support tools for command and control will remain a top priority for the U.S. government. |

| • | A Continued Commitment to Long-Running Overseas Contingencies Operations. Even with the U.S. military drawdown in Iraq, there will still be hundreds of thousands of uniformed U.S. service members deployed worldwide, especially on long-running overseas contingencies operations, or OCOs, in the Middle East and Afghanistan. President Obama committed an additional 21,000 troops to Afghanistan in March 2009. Whether or not the President approves an additional deployment of combat troops or simply commits to a surge in military training, capacity building, and reconstruction, the U.S. military footprint in Afghanistan will increase. The surge in troop levels there and the commitment to other operations worldwide entails a rise in the need for services, technology and engineering solutions to support those deployments. |

2

Table of Contents

Our Business Strengths and Competitive Advantages

We believe that we are well-positioned to capitalize on the market opportunities presented by the Obama administration’s defense and intelligence spending priorities and to support the ongoing and new requirements of customers and programs in these mission-critical areas:

| • | Alignment with Policy Priorities and Military Requirements. Our core capabilities and exemplary past performance are well-aligned with the top priorities of the Obama administration and the national security community. Our capabilities and expertise closely match current and expected future requirements in the defense, intelligence and homeland security communities. |

| • | Highly Skilled Workforce with High-Level Security Clearances. Over 425 of our approximately 675 employees have security clearances and two-thirds of those are at the Top Secret level or above. In the parts of our business that support counter-terrorism programs and command, control, communications, computers, intelligence, surveillance and reconnaissance (C4ISR) efforts, over 90% of the employees have clearances. Over 20% of our employees have advanced degrees, principally in technical sciences, and 48 of our employees hold Ph.D.’s. |

| • | Strong Contract Base. Over 80% of our revenue is derived from our work with the U.S. government as a prime contractor. Certain of our contracts provide flexible enough procurement vehicles to allow an array of existing or new customers to engage us quickly and efficiently to meet their mission-critical needs. |

| • | Long-Term Customer Relationships Based on Our Mission-Focused Culture. We have worked with many of our customers for long periods of time, decades in some cases. We believe that key factors contributing to the longevity of our customer relationships are our mission-focused culture and the subject matter expertise and level of understanding we have of our customers’ requirements. |

| • | Proprietary Technology, Intellectual Property and Know-How. We create and own intellectual property and know-how relating to technologies, processes, and methods. Our innovations in sensor integration, decision support systems for both the military and intelligence markets, maritime navigation, network and communications management, tactical water purification and reuse, and highly engineered force mobility support solutions have enhanced our reputation in the industry as an innovative mission systems provider. |

| • | Disciplined and Experienced Growth-Oriented Executive Management Team. The members of our executive management team have a successful track record of identifying, pursuing and executing on key growth opportunities in the military and national security marketplaces, both through organic business development and the pursuit of strategic acquisition opportunities. |

Our Growth Strategy

Our objective is to become a leading mid-sized defense and national security technology company that is clearly differentiated from our competitors by our mission solutions. To achieve our objective, we intend to:

| • | Focus on Growth Segments in the National Security Space. We intend to expand our position in well-funded and rapidly growing U.S. government national security programs and policy priorities such as counter-terrorism, force mobility and modernization, technology solutions for data fusion, mission-focused command, control and decision support tools, and building net-centric C4ISR systems. |

| • | Expand Customer Presence and Increase Base of Customers/Contracts. We plan to increase our level of business from our existing customer base by expanding the range of services we provide to customers with whom we have developed successful relationships. We also intend to broaden our national security client base to other agencies and military services that require services similar to those we provide to existing customers, but with whom we do not now perform a large amount of work. |

3

Table of Contents

| • | Pursue Strategic Acquisitions. We will actively pursue focused strategic acquisitions that enhance and expand our core capabilities and broaden our customer base into other high-growth national security segments consistent with our overall strategic objectives. Combined with our continued organic growth, this will provide both new customers, capabilities, technologies and talent and the additional critical mass to pursue larger-scale, technology-based national security contracts. |

| • | Pursue Larger and More Complex Contracts as a Prime Contractor. We intend to leverage our strong set of complementary capabilities to win larger and more complex contracts as a prime contractor in key areas such as C4ISR, counter-terrorism/intelligence, and force mobility and modernization. We will continue to base our bid strategies on the differentiated solutions we provide to the customer and our intimate knowledge of customers’ mission requirements. |

| • | Maintain Our Technical Leadership. We intend to continue to attract and retain highly skilled employees and focus our research and development efforts in high-value areas such as network communications and management, sensor integration, decision support tools, data fusion systems, and the design, engineering and integration of highly mobile mission support systems to maintain our proprietary leading-edge technical position. |

Our History and Organizational Structure

In 2006, our indirect parent, Global Strategies Group Holding, S.A., which we refer to as GLOBAL, formed Contego Systems Inc., which in turn established Global Technology Strategies, Inc., for the purpose of commencing technology operations in the U.S. and hired Ronald Jones who, immediately prior to the effectiveness of this offering, will become our Executive Vice President, Corporate Development, to lead this effort. On February 9, 2007, Global Technology Strategies, Inc. acquired SFA, Inc., which we refer to as SFA. SFA was originally founded in 1969 as Sachs Freeman Associates, a provider of technology services to the federal government. SFA grew organically for most of the 38 years prior to its acquisition, and also completed two acquisitions. In 1988, SFA acquired Frederick Manufacturing and, in 2003, it acquired TAC.

Subsequent to the SFA acquisition, SFA was renamed Global Strategies Group (North America) Inc., or GNA, and Global Technology Strategies, Inc. was renamed Global Strategies Group Holding (North America) Inc., or GNA Holding. GNA and TAC are our operating subsidiaries. At the end of 2008, as part of a restructuring, we were formed as a wholly owned subsidiary of Contego Systems Inc. under the name Contego NewCo Company, a Delaware corporation, and immediately thereafter Contego Systems Inc. was converted into Contego Systems LLC. Our name was changed to Global Defense Technology & Systems, Inc. in July 2009. Our principal executive offices are located at 1501 Farm Credit Drive, Suite 2300, McLean, Virginia 22102. Our website address is www.globalgroup.us.com. Information contained on our website is not part of this prospectus.

From the date of the SFA acquisition, we have operated separately from GLOBAL and its other affiliates, with a board, including three independent directors, and have focused exclusively on customers in the U.S. government. We believe that our initial public offering and Nasdaq listing will provide the following benefits:

| • | direct access to a new institutional and retail investor base; |

| • | increased use of equity compensation to align the interests of our employees with those of our stockholders; and |

| • | opportunities to pursue acquisitions and other strategic initiatives using our publicly traded stock as acquisition currency. |

Upon conclusion of this offering, GLOBAL will be our largest beneficial stockholder, owning approximately [—]% of our outstanding stock, assuming the underwriters do not exercise their overallotment option.

4

Table of Contents

In anticipation of this offering, immediately prior to this offering, we will implement a series of restructuring transactions. The historical financial statements included elsewhere in this prospectus have not been adjusted for the 60,000-for-1 stock split. Otherwise, the information in this prospectus reflects and assumes that the following restructuring transactions have been effected unless otherwise indicated:

| • | the amendment and restatement of our certificate of incorporation and bylaws to, among other things, increase the number of shares of our authorized stock; |

| • | a 60,000-for-1 stock split of our common stock which will be approved by our Board of Directors prior to the consummation of this offering; |

| • | the merger of GNA Holding with and into GNA, resulting in GNA becoming our direct, wholly owned subsidiary; |

| • | our assumption of all options previously granted pursuant to the SFA, Inc. 2007 Stock Option Plan, or SFA Plan, and appropriate adjustments to the number of shares of common stock underlying such options as well as the exercise price of such options; and |

| • | the redemption by Contego Systems LLC of all of the membership interests owned by Ronald Jones, in exchange for shares of our common stock owned by Contego Systems LLC of equal value. |

In addition, unless otherwise indicated, the information in this prospectus reflects and assumes:

| • | the issuance of 36,432 shares of common stock to James Allen, our Executive Vice President and Chief Financial Officer, upon the closing of this offering; |

| • | the issuance of options to purchase 32,789 shares of common stock to Kirk Herdman, our Senior Vice President, Business Operations and Development, upon closing of this offering; and |

| • | no exercise of the underwriters’ overallotment option to purchase up to [—] additional shares of our common stock from one of the selling stockholders. |

5

Table of Contents

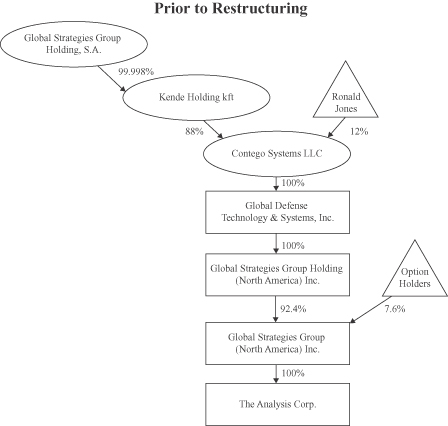

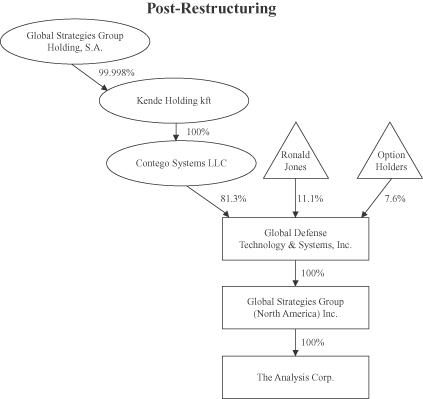

The following sets forth our organizational structure immediately before and after the restructuring transactions on a fully-diluted basis.

6

Table of Contents

7

Table of Contents

The Offering

| Common stock offered by us |

[—] shares |

| Common stock offered by the selling stockholders . . . |

[—] shares |

| Common stock to be outstanding after this offering |

[—] shares |

| Underwriters’ option to purchase additional shares . . . |

[—] shares |

| Use of proceeds |

To repay (i) the term loan portion of our credit facility, which was $10.8 million as of June 30, 2009, (ii) other outstanding borrowings under our credit facility, which were $16.6 million as of June 30, 2009, and (iii) to the extent of any excess net proceeds after repayment of the previous debt, debt owed to GLOBAL and its affiliates, which was $16.4 million as of June 30, 2009, and for general corporate purposes, including future acquisitions. We will not receive any proceeds from the sale of our common stock by the selling stockholders. |

| Risk factors |

See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

| Proposed Nasdaq Global Market symbol |

GTEC |

The number of shares of common stock to be outstanding after this offering is based on the number of shares outstanding as of [—], 2009. Such number excludes:

| • | 492,128 shares of common stock issuable upon the exercise of options to purchase our common stock at a weighted average exercise price of $[—] per share, which options were previously granted to employees pursuant to the SFA Plan and will be assumed by the Company in connection with this offering; |

| • | 32,789 shares of common stock, issuable upon exercise of options to purchase our common stock at the public offering price to be granted to Kirk Herdman, our Senior Vice President, Business Operations and Development, upon closing of this offering; and |

| • | [—] shares of common stock, reserved for future issuance under our 2009 Performance Incentive Plan, or the Plan, which we will adopt in connection with this offering. |

8

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The summary consolidated financial information set forth below for the period April 1, 2006 to February 8, 2007, the period February 9, 2007 to December 31, 2007 and for the year ended December 31, 2008 has been derived from audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated financial information set forth below for the six months ended June 30, 2008 and 2009 has been derived from our unaudited financial statements included elsewhere in this prospectus. The unaudited financial statements have been prepared on the same basis as the audited financial statements and, in the opinion of our management, include all normal recurring adjustments necessary for a fair presentation of the information set forth herein. Our historical results are not necessarily indicative of the results that may be expected for any future period. The information below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes thereto included in this prospectus.

Basis of Presentation

In 2006, our indirect parent, GLOBAL, formed Contego Systems Inc. and Global Technology Strategies, Inc. for the purpose of commencing technology operations in the U.S. On February 9, 2007, Global Technology Strategies, Inc. acquired all of the outstanding stock of SFA and its subsidiary, TAC. Subsequent to the SFA acquisition, SFA was renamed GNA, and Global Technology Strategies, Inc. was renamed GNA Holding. GNA and TAC are our operating subsidiaries. On December 31, 2008, as part of a restructuring, (i) we were formed under the name Contego NewCo Company, (ii) Contego Systems Inc. transferred all of its assets to us and we assumed all of Contego Systems Inc.’s liabilities and (iii) Contego Systems Inc. was converted into Contego Systems LLC. In July 2009, we changed our name to Global Defense Technology & Systems, Inc.

SFA and its subsidiary, TAC, are the predecessor entity, which we refer to as the Predecessor for accounting purposes since their operations represent our principal business. The historical results of SFA and its subsidiary, TAC, have been presented from April 1, 2006 through February 8, 2007, the date prior to the date of the SFA acquisition. The consolidated financial statements of GLOBAL Defense Technology, which include, in addition to the Predecessor, GNA Holding and GNA, have been presented from February 9, 2007 through December 31, 2007 and for the year ended December 31, 2008. The Successor’s financial statements also include the historical results of Contego Systems Inc., which consists of general and administrative expense incurred on behalf of GNA, for the period from February 9, 2007 through December 31, 2007 and for the year ended December 31, 2008.

Immediately prior to effectiveness of the registration statement of which this prospectus forms a part, we will implement a series of restructuring transactions, including (i) a 60,000-for-1 stock split of our common stock which will be approved by our Board of Directors prior to the consummation of this offering and (ii) the assumption of all options previously granted pursuant to the SFA Plan, and appropriate adjustments to the number of shares of common stock underlying such options as well as the exercise price of such options. We expect that the exchange of stock options in GNA for stock options in GLOBAL Defense Technology will represent a probable-to-probable type modification in accordance with Statement of Financial Accounting Standards (SFAS) No. 123R, Share-Based Payments, or SFAS No. 123R. We do not anticipate that this modification will result in incremental fair value because the terms affecting the fair value will not be modified. Therefore, we do not expect to recognize any additional compensation expense on the modification date. See “Prospectus Summary—Our History and Organizational Structure” for more information regarding the restructuring transactions. As a result of the restructuring transactions, the weighted average common shares outstanding and earnings (loss) per share figures presented in our historical financial statements and notes thereto, and all references to options, common shares and exercise price figures in note 10 to our consolidated financial statements, will be revised accordingly.

The balance sheet data as of June 30, 2009 is presented:

| • | on an actual basis; and |

9

Table of Contents

| • | on an as adjusted basis to reflect our sale of common stock in this offering at an assumed initial public offering price of $[—] per share (the mid-point of the range set forth on the cover page of this prospectus), and receipt of the net proceeds, after deducting estimated underwriting discounts and commissions and estimated offering expenses and application of the proceeds therefrom. |

A $1.00 increase (decrease) in the assumed initial public offering price of $[—] per share would increase (decrease) cash and cash equivalents, working capital, total assets and total stockholders’ equity by $[—] million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same after deducting estimated underwriting discounts and commissions.

| Predecessor | Successor | |||||||||||||||||||||

| (in thousands, except share and per share data) | Period April 1, 2006 to February 8, 2007 |

Period February 9 to December 31, 2007 |

Year Ended December 31, 2008 |

Six Months Ended June 30, | ||||||||||||||||||

| 2008 | 2009 | |||||||||||||||||||||

| Consolidated Statements of Operations |

||||||||||||||||||||||

| Revenue |

$ | 123,124 | $ | 134,818 | $ | 189,426 | $ | 93,167 | $ | 103,040 | ||||||||||||

| Operating costs and expenses |

||||||||||||||||||||||

| Cost of revenue |

105,644 | 114,264 | 156,271 | 79,183 | 85,664 | |||||||||||||||||

| Selling, general and administrative expenses |

16,317 | 13,202 | 16,957 | 7,702 | 9,253 | |||||||||||||||||

| Amortization of intangible assets |

72 | 10,279 | 8,841 | 4,595 | 4,178 | |||||||||||||||||

| Impairment of intangible asset |

— | — | 2,447 | — | — | |||||||||||||||||

| Total operating costs and expenses |

122,033 | 137,745 | 184,516 | 91,480 | 99,095 | |||||||||||||||||

| Operating income (loss) |

1,091 | (2,927 | ) | 4,910 | 1,687 | 3,945 | ||||||||||||||||

| Other income (expense) |

||||||||||||||||||||||

| Interest income |

270 | 46 | 40 | 7 | 3 | |||||||||||||||||

| Interest expense |

(67 | ) | (3,594 | ) | (2,750 | ) | (1,444 | ) | (1,000 | ) | ||||||||||||

| Income (loss) before income taxes |

1,294 | (6,475 | ) | 2,200 | 250 | 2,948 | ||||||||||||||||

| (Provision for)/benefit from income taxes |

(2,116 | ) | 2,406 | (1,138 | ) | (116 | ) | (1,388 | ) | |||||||||||||

| Net (loss) income |

$ | (822 | ) | $ | (4,069 | ) | $ | 1,062 | $ | 134 | $ | 1,560 | ||||||||||

| Earnings (loss) per share |

||||||||||||||||||||||

| Basic(1) |

$ | (2.49 | ) | $ | (40,691.68 | ) | $ | 10,618.56 | $ | 1,341.84 | $ | 15,604.04 | ||||||||||

| Diluted(1) |

$ | (2.49 | ) | $ | (40,691.68 | ) | $ | 10,618.56 | $ | 1,341.84 | $ | 15,560.83 | ||||||||||

| Weighted average common shares outstanding |

||||||||||||||||||||||

| Basic |

329,378 | 100 | 100 | 100 | 100 | |||||||||||||||||

| Diluted |

329,378 | 100 | 100 | 100 | 100 | |||||||||||||||||

| Cash dividends per share |

$ | 8.66 | $ | — | $ | — | $ | — | $ | — | ||||||||||||

| As of June 30, 2009 | |||||||

| Actual | As Adjusted | ||||||

| (in thousands) | |||||||

| Consolidated Balance Sheet |

|||||||

| Cash and cash equivalents |

$ | 217 | $ | [ | —] | ||

| Working capital(2) |

29,718 | [ | —] | ||||

| Total assets |

115,024 | [ | —] | ||||

| Debt(3) |

43,825 | [ | —] | ||||

| Total stockholders’ equity |

44,842 | [ | —] | ||||

10

Table of Contents

| Predecessor | Successor | ||||||||||||||||

| Period April 1, 2006 to February 8, 2007 |

Period February 9 to December 31, 2007 |

Year Ended December 31, 2008 |

Six Months Ended June 30, | ||||||||||||||

| (in thousands) | 2008 | 2009 | |||||||||||||||

| Other Data | |||||||||||||||||

| EBITDA(4) |

$ | 1,884 | $ | 8,108 | $ | 14,747 | $ | 6,779 | $ | 8,620 | |||||||

| Adjusted EBITDA(5) |

$ | 8,545 | $ | 9,226 | $ | 18,417 | $ | 7,407 | $ | 9,689 | |||||||

| (1) | See note 13 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the method used to calculate basic and diluted earnings (loss) per share. |

| (2) | Working capital is defined as current assets net of current liabilities excluding all affiliated debt and the current portion of long-term debt. |

| (3) | Represents bank loans (including current maturities) and loans from affiliates. |

| (4) | EBITDA is defined as net income before net interest expense, income tax expense, depreciation and amortization. EBITDA is a financial measure that is not calculated in accordance with generally accepted accounting principles, or GAAP. EBITDA should not be considered as an alternative to net income (loss), operating income (loss) or any other measure of financial performance calculated and presented in accordance with GAAP. We prepare EBITDA to eliminate the impact of items that we do not consider indicative of our core operating performance. We encourage you to evaluate these adjustments and the reasons we consider them appropriate. |

We believe EBITDA is useful to investors in evaluating our operating performance because:

| • | securities analysts use EBITDA as a supplemental measure to evaluate the overall operating performance of companies and we anticipate that our investor and analyst presentations after we are public will include EBITDA; and |

| • | we believe that the elimination of certain non-cash, non-operating or non-recurring items enables a more consistent measurement of period to period performance of our operations, as well as a comparison of our operating performance to companies in our industry. |

Our management uses EBITDA:

| • | as a measure of operating performance; |

| • | for planning purposes, including the preparation of our annual operating budget; |

| • | to allocate resources to enhance the financial performance of our business; |

| • | to evaluate the effectiveness of our business strategies; |

| • | in communications with our board of directors concerning our financial performance; and |

| • | to determine compliance with financial covenants under our credit facility. |

Although EBITDA is frequently used by investors and securities analysts in their evaluations of companies, EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results of operations as reported under GAAP. Some of these limitations are:

| • | EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or other contractual commitments; |

| • | EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| • | EBITDA does not reflect interest expense or interest income; |

| • | EBITDA does not reflect cash requirements for income taxes; |

11

Table of Contents

| • | although depreciation and amortization are non-cash charges, the assets being depreciated or amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for these replacements; and |

| • | other companies in our industry may calculate EBITDA or similarly titled measures differently than we do, limiting its usefulness as a comparative measure. |

| (5) | Adjusted EBITDA represents EBITDA adjusted for impairment of intangible asset and certain items that were directly or indirectly related to the capital structure and accounting treatment of the Predecessor prior to the SFA acquisition and that no longer apply to us. Adjusted EBITDA is a financial measure that is not calculated in accordance with GAAP. Adjusted EBITDA should not be considered as an alternative to net income (loss), operating income (loss) or any other measure of financial performance calculated and presented in accordance with GAAP. Our Adjusted EBITDA may not be comparable to similarly titled measures of other companies because other companies may not calculate Adjusted EBITDA or similarly titled measures in the same manner as we do. We use Adjusted EBITDA: |

| • | for purposes of comparing our EBITDA following the SFA acquisition to our Predecessor’s EBITDA prior to the SFA acquisition; and |

| • | to evaluate our operating results without the additional variations caused by the impairment of intangible asset, which is non-recurring. |

Reconciliation of net income (loss) to Adjusted EBITDA is presented below:

| Predecessor | Successor | ||||||||||||||||||

| (in thousands) | Period April 1, 2006 to February 8, 2007 |

Period February 9 to December 31, 2007 |

Year Ended December 31, 2008 |

Six Months Ended June 30, | |||||||||||||||

| 2008 | 2009 | ||||||||||||||||||

| Net income (loss) |

$ | (822 | ) | $ | (4,069 | ) | $ | 1,062 | $ | 134 | $ | 1,560 | |||||||

| Depreciation and amortization |

721 | 756 | 996 | 497 | 497 | ||||||||||||||

| Amortization of intangibles |

72 | 10,279 | 8,841 | 4,595 | 4,178 | ||||||||||||||

| Interest (income) expense, net |

(203 | ) | 3,548 | 2,710 | 1,437 | 997 | |||||||||||||

| Income tax expense (benefit) |

2,116 | (2,406 | ) | 1,138 | 116 | 1,388 | |||||||||||||

| EBITDA |

1,884 | 8,108 | 14,747 | 6,779 | 8,620 | ||||||||||||||

| Impairment of intangible asset(a) |

— | — | 2,447 | — | — | ||||||||||||||

| Stock appreciation rights (SARs) expense(b) |

3,178 | — | — | — | — | ||||||||||||||

| Sellers transaction costs(c) |

1,433 | — | — | — | — | ||||||||||||||

| ESOP expense(d) |

2,050 | — | — | — | — | ||||||||||||||

| Retention bonuses(e) |

— | 1,108 | 1,195 | 605 | — | ||||||||||||||

| Management fees paid to GLOBAL(f) |

— | 10 | 28 | 23 | 1,069 | ||||||||||||||

| Adjusted EBITDA |

$ | 8,545 | $ | 9,226 | $ | 18,417 | $ | 7,407 | $ | 9,689 | |||||||||

| (a) | Reflects charge associated with abandonment of GNA’s former trade name. |

| (b) | Reflects expense associated with the vesting of employee stock appreciation rights effective with the acquisition of SFA. |

| (c) | Reflects expenses incurred by SFA in conjunction with its sale to us. |

| (d) | Reflects expense associated with the Employee Stock Ownership Plan, whereby SFA funded a portion of employees purchase price, prior to the date of acquisition of SFA. |

| (e) | Consists of retention bonuses paid to SFA employees in connection with continued employment subsequent to the SFA acquisition. |

| (f) | Consists principally of management fees paid to an affiliate of GLOBAL pursuant to a management services agreement that was initiated January 1, 2009. Following completion of this offering, the agreement will be terminated and, because any services previously provided by GLOBAL and its affiliates will be provided on a going-forward basis by our existing employees, we will not incur any additional cost or expense related to these services. |

12

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the other information set forth in this prospectus before deciding to invest in shares of our common stock. If any of the events or developments described below occur, our business, financial condition or results of operations could be negatively affected. In that case, the trading price of our common stock could decline, and you could lose all or part of your investment in our common stock.

Risks Related to Our Business

We depend on contracts with the U.S. government for substantially all of our revenue. If our relationships with U.S. government agencies were harmed, our business, future revenue and growth prospects would be adversely affected.

We derive substantially all of our revenue from our U.S. government customers. We expect that U.S. government contracts will continue to be the primary source of our revenue for the foreseeable future. Our business, prospects, financial conditional or operating results would be materially harmed if:

| • | the government ceases to do business with us, or significantly decreases the amount of business it does with us; |

| • | we were suspended or debarred from contracting with the U.S. government or a significant government agency; or |

| • | our reputation or relationship or that of our senior managers with the government agencies with which we currently do business or seek to do business is impaired. |

U.S. government spending and mission priorities may change in a manner that adversely affects our future revenue and limits our growth prospects.

Our business depends upon continued U.S. government expenditures on intelligence, defense and other programs for which we provide support. These expenditures have not remained constant over time and have been reduced in certain periods. For example, the overall U.S. defense budget declined for certain periods of time in the late 1980s and the early 1990s, resulting in a slowing of new program starts, program delays and program cancellations. These reductions caused many defense-related government contractors to experience declining revenue, increased pressure on operating margins and, in some cases, net losses. While spending authorizations for intelligence and defense-related programs by the government have increased in recent years, and in particular after the 2001 terrorist attacks and more recently as a result of action in support of military and civil activity in Afghanistan and Iraq, future levels of expenditure, mission priorities and authorizations for these programs may decrease or shift to programs in areas where we do not currently provide services. Our business, prospects, financial condition or operating results could be materially harmed among other causes by the following:

| • | budgetary constraints affecting U.S. government spending generally, or specific departments or agencies in particular, and changes in available funding; |

| • | changes in U.S. government programs or requirements; |

| • | U.S. government shutdowns (such as that which occurred during fiscal year 1996) and other potential delays in the appropriations process; |

| • | realignment of funding with changed federal government priorities, which may impact the U.S. war efforts, including reductions in funding for in-theater missions; and |

| • | curtailment of the U.S. government’s outsourcing of mission-critical support and IT services. |

These or other factors could cause U.S. government agencies and departments to reduce their purchases under contracts, exercise their right to terminate contracts, or not exercise options to renew contracts, any of which could cause us to lose revenue. A significant decline in overall U.S. government spending, or a shift in expenditures away from agencies or programs that we support, could cause a material decline in our revenue.

13

Table of Contents

We rely on a few large contracts for a significant portion of our revenue and net income. The loss of any one or more of these contracts could cause a material decline in our operating results.

For the year ended December 31, 2008, we had three contracts, each accounting for over 10% of our revenue, for a total of $91.0 million, or 48.1% of our total revenue. For the six month period ended June 30, 2009, we had two contracts, each accounting for over 10% of our revenue, for a total of $40.7 million, or 39.5% of our total revenue. Although we have been successful in continuing work on most of our large contracts in the past, there is no assurance that we will be able to do so in the future. The revenue stream from one or more of these contracts could end for a number of reasons, including the completion of the customer’s requirements, the completion or early termination of our current contract, the consolidation of our work into another contract where we are not the holder of that contract, or the loss of a competitive bid for the follow-on work related to our current contract. If any of these events were to occur, we could experience an unexpected, significant reduction in revenue and net income. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion with respect to these contracts.

We may lose money on some contracts if we do not accurately estimate the expense, time and resources necessary to satisfy our contractual obligations.

We enter into three types of federal government contracts for our systems and services: fixed-price, time-and-materials and cost-plus. For the six month period ended June 30, 2009 and for the same period in 2008, we derived revenue from such contracts as follows:

| Six months ended, June 30, |

||||||

| Contract Type |

2009 | 2008 | ||||

| Fixed-price |

57.0 | % | 60.0 | % | ||

| Time-and-materials |

30.5 | % | 28.5 | % | ||

| Cost-plus |

12.5 | % | 11.5 | % | ||

Each of these types of contracts, to varying degrees, involves some risk that we could underestimate our cost of fulfilling the contract, which may reduce the profit we earn or lead to a financial loss on the contract.

Under fixed-price contracts, we perform specific tasks for a fixed price. Compared to cost-plus contracts, fixed-price contracts generally offer higher margin opportunities but involve greater financial risk because we bear the impact of cost overruns and bear the risk of underestimating the level of effort required to perform the contractual obligations. The increased costs and expenses could produce a loss on the performance of the contract.

Under time-and-materials contracts, we are reimbursed for labor at negotiated hourly billing rates and for certain expenses. We assume financial risk on time-and-material contracts because we assume the risk of performing those contracts at fixed hourly rates.

Under cost-plus contracts, we are reimbursed for allowable costs and paid a fee, which may be fixed or performance-based. To the extent that the actual costs incurred in performing a cost-plus contract are within the contract ceiling and allowable under the terms of the contract and applicable regulations, we are entitled to reimbursement of our costs, plus a profit. However, if our costs exceed the ceiling or are not allowable under the terms of the contract or applicable regulations, we may not be able to recover those excess or unallowable costs.

Our profits could be adversely affected if our costs under any of these contracts exceed the assumptions we used in bidding for the contract. Over time, and particularly if we acquire other businesses, our contract mix may change, to include a greater proportion of fixed-price or time-and-materials contracts, which would increase our exposure to these risks.

14

Table of Contents

If we fail to comply with complex procurement laws and regulations, we could lose business and be liable for various penalties or sanctions.

We must comply with laws and regulations relating to the formation, administration and performance of federal government contracts. These laws and regulations affect how we conduct business with our federal government customers. In complying with these laws and regulations, we may incur significant costs, and non-compliance may allow for the imposition of additional fines and penalties, including contractual damages. Among the more significant laws and regulations affecting our business are the following:

| • | the Federal Acquisition Regulation, which comprehensively regulates the formation, administration and performance of federal government contracts; |

| • | the Truth in Negotiations Act, which requires certification and disclosure of all cost and pricing data in connection with contract negotiations; |

| • | the Cost Accounting Standards and Cost Principles, which imposes accounting requirements that govern our right to reimbursement under certain cost-based federal government contracts; and |

| • | laws, regulations and executive orders restricting the use and dissemination of classified information and, under U.S. export control laws, the export of certain products and technical data. |

Our contracting agency customers periodically review our performance under and compliance with the terms of our federal government contracts. If we fail to comply with these control regimes or if a government review or investigation uncovers improper or illegal activities, we may be subject to civil or criminal penalties or administrative sanctions, including:

| • | termination of contracts; |

| • | forfeiture of profits; |

| • | cost associated with triggering of price reduction clauses; |

| • | suspension of payments; |

| • | fines; and |

| • | suspension or debarment from doing business with federal government agencies. |

Additionally, the False Claims Act provides for potentially substantial civil penalties where, for example, a contractor presents a false or fraudulent claim to the government for payment or approval. Actions under the False Claims Act may be brought by the government or by other persons on behalf of the government (who may then share a portion of any recovery).

Because we are under foreign ownership, control or influence (FOCI), and our subsidiary is performing on U.S. classified contracts, we are a party to a Special Security Agreement with the Department of Defense and are subject to other requirements of the National Industrial Security Program Operating Manual, which impose significant compliance obligations upon us. Our failure to comply with these obligations could result in our not being able to continue performing under our U.S. classified contracts, which would have a material adverse effect on our business.

We operate under a Special Security Agreement, or SSA, with the Department of Defense. If a company’s ownership structure presents the potential for foreign ownership, control, or influence, or FOCI, then the Department of Defense may require certain protective measures to mitigate the FOCI (such as an SSA) in order for the company and its subsidiaries to have security clearances. According to the National Industrial Security Program Operating Manual, or NISPOM, a company is under FOCI if its foreign parent “has the power, direct or indirect, whether or not exercised, and whether or not exercisable through the ownership of the U.S. company’s securities, by contractual arrangements or other means, to direct or decide matters affecting the management or operations of that company in a manner which may result in unauthorized access to classified information or may adversely affect the performance of classified contracts.” Because a significant percentage of our voting equity is

15

Table of Contents

owned by a non-U.S. entity, we have been determined to be under FOCI, and are therefore required to operate pursuant to an SSA in order for our subsidiary to be able to maintain the requisite security clearances to access classified information and perform on classified contracts.

We currently maintain a Top Secret level facility security clearance, or FCL, under the SSA and derive a significant portion of our revenue from classified contracts. If we were to violate the terms and requirements of the SSA, the NISPOM, or any other applicable U.S. government industrial security regulations, we could lose our FCL. We cannot give any assurance that we will be able to maintain our FCL. If for some reason our FCL is suspended, invalidated or terminated, we may not be able to continue to perform our classified contracts in effect at that time or enter into new classified contracts. This would result in our not being able to recognize revenue and would thereby have a material adverse effect on our business, results of operations and financial condition.

We derive most of our revenue from contracts awarded through a competitive bidding process. This process can impose substantial costs upon us and we may lose revenue if we fail to compete effectively.

We derive most of our revenue from federal government contracts that are awarded through a competitive bidding process and we expect that solicitation will continue for the foreseeable future. Competitive bidding presents a number of risks, including:

| • | bidding on programs in advance of the completion of their design, which may result in unforeseen technological difficulties and cost overruns; |

| • | devoting substantial resources and managerial time and effort to preparing bids and proposals for contracts that are not awarded to us, which may result in reduced profitability; |

| • | failing to accurately estimate the resources and cost structure that will be required to service any contract we are awarded; |

| • | incurring expense and delay due to a competitor’s protest or challenge of contract awards made to us, including the risk that any such protest or challenge could result in the resubmission of bids on modified specifications, or in the termination, reduction or modification of the awarded contract, either of which may result in reduced profitability; |

| • | changes to client bidding practices or government reform of procurement practices, which may alter the prescribed contract relating to contract vehicles, contract types and consolidations; and |

| • | changes in policy and goals by the government providing set-aside funds to small businesses or disadvantaged businesses, and other socio-economic requirements in the allocation of contracts. |

If we are unable to win particular contracts that are awarded through the competitive bidding process, in addition to the risk that our operating results may be adversely affected, we may be unable to operate in the market for services that are provided under those contracts for a number of years. Even if we win a particular contract through competitive bidding, our profit margins may be depressed as a result of the costs incurred in the bidding process.

We face intense competition from many competitors that, among other things, have greater resources than we do.

We operate in highly competitive markets and generally encounter intense competition to win contracts and task orders. We compete with many other firms, ranging from small, specialized firms to mid-tier technology firms and large, diversified firms, many of which have substantially greater financial, management and marketing resources than we do. Our competitors may be able to provide our customers with different or greater capabilities or benefits than we can in areas such as technical qualifications, past contract performance, geographic presence, price and the availability of qualified professional personnel. Our failure to compete effectively because of any of these or other factors could cause our revenue and operating profits to decline. In addition, our competitors also have established or may establish relationships among themselves or with third parties to increase their ability to address our customers’ needs. Accordingly, it is possible that new competitors or alliances among competitors may emerge that would compete with us more effectively than currently.

16

Table of Contents

Further, we may face competition from our subcontractors who, from time to time, seek to obtain prime contractor status on contracts for which they currently serve as a subcontractor for us. If one or more of our current subcontractors are awarded prime contractor status on such contracts in the future, it would divert sales from us and could force us to charge lower prices in order to ensure that we retain our prime contractor status.

Our estimated contract backlog may not result in actual revenue.

As of June 30, 2009, our estimated contract backlog totaled $452.8 million, of which $120.9 million was funded. There can be no assurance that our backlog will result in actual revenue in any particular period, or at all, or that any contract included in our backlog will be profitable. There is a higher degree of risk in this regard with respect to unfunded backlog. The actual receipt and timing of any revenue is subject to various contingencies, many of which are beyond our control. The actual receipt of revenue on contracts included in backlog may never occur or may change because a program schedule could change, the program could be cancelled, a contract could be reduced, modified or terminated early, or an option that we had assumed would be exercised may not be exercised. Further, while many of our federal government contracts require performance over a period of years, Congress often appropriates funds for these contracts for only one year at a time. Consequently, our contracts typically are only partially funded at any point during their term, and all or some of the work intended to be performed under the contracts will remain unfunded pending subsequent Congressional appropriations and the obligations of additional funds to the contract by the procuring agency. Our estimates are based on our experience under such contracts and similar contracts. However, there can be no assurance that all or any, of such estimated contract value will be recognized as revenue.

The loss of any member of our senior management could impair our relationships with federal government clients and disrupt the management of our business.

We believe that the success of our business and our ability to operate profitably depends on the continued contributions of the members of our senior management. We rely on our senior management to generate business and execute programs successfully. In addition, the relationships and reputation that many members of our senior management team have established and maintain with federal government personnel contribute to our ability to maintain strong client relationships. Therefore, the loss of any member of our senior management could impair our ability to identify and secure new contracts, to maintain good client relations and to otherwise manage our business.

If we fail to attract and retain skilled employees, we might not be able to perform under our contracts and our ability to maintain and grow our business could be limited.

The growth of our business and revenue depends in large part upon our ability to attract and retain sufficient numbers of highly qualified individuals who have advanced engineering and information technology skills, specialized knowledge of customer missions and appropriate security clearances, and who work well with our government customers. Competition for such personnel is intense, and recruiting, training and retention costs place significant demands on our resources. If we are unable to recruit and retain a sufficient number of qualified employees, our ability to maintain and grow our business could be limited. Furthermore, we could be required to engage larger numbers of independent contractors, which could increase our costs and reduce our profit margins. In addition, many of our professional personnel may have specific knowledge of, and experience with, our federal government customers’ operations, and we may obtain some of our contracts based on that knowledge and experience. The loss of services of key personnel could impair our ability to perform required services under some of our contracts and to retain such contracts, as well as our ability to win new business.

Recent events affecting the credit markets may restrict our ability to access additional financing.

The U.S. and worldwide capital and credit markets have recently experienced significant price volatility, dislocations and liquidity disruptions, which have caused market prices of many stocks to fluctuate substantially and the spreads on prospective debt financings to widen considerably. These circumstances have materially impacted liquidity in the financial markets, making terms for certain financings less attractive, and in some cases

17

Table of Contents

have resulted in the unavailability of financing. Continued uncertainty in the capital and credit markets may negatively impact our business, including our ability to access additional financing at reasonable terms. A prolonged downturn in the financial markets may cause us to seek alternative sources of potentially less attractive financing, and may require us to adjust our business plan accordingly, including abandoning one of our key growth strategies, to selectively pursue acquisitions. These events also may make it more difficult or costly for us to raise capital through the issuance of our equity securities. The disruptions in the financial markets may have a material adverse effect on the market value of our common stock and other adverse effects on our business.

Internal system or service failures could disrupt our business and impair our ability to effectively provide our products and services to our customers, which could damage our reputation and adversely affect our revenue and profitability.

We may be subject to systems failures, including network, software or hardware failures, whether caused by us, third-party service providers, intruders or hackers, computer viruses, natural disasters, power shortages or terrorist attacks. Any such failures could cause loss of data and interruptions or delays in our business, cause us to incur remediation costs, subject us to claims and damage our reputation. In addition, the failure or disruption of our communications or utilities could cause us to interrupt or suspend our operations or otherwise adversely affect our business. Our property and business interruption insurance may be inadequate to compensate us for all losses that may occur as a result of any system or operational failure or disruption and, as a result, our future results could be adversely affected.

Our quarterly operating results may fluctuate significantly as a result of factors outside our control, which could cause the market price of our common stock to decline.

Our revenue and operating results vary from quarter to quarter and, as a result, our operating results may fall below the expectations of securities analysts and investors, which could cause the price of our common stock to decline. Factors that may affect our operating results include those listed in this “Risk Factors” section and others that are specific to our industry, such as:

| • | fluctuations in revenue earned on government contracts; |

| • | seasonal fluctuations in our staff utilization rates; |

| • | commencement, completion or termination of contracts during any particular quarter; |

| • | variable purchasing patterns of our customers; |

| • | changes in contract requirements by our government agency customers, particularly with respect to customer requirements for our expeditionary systems; and |

| • | changes in presidential administrations and senior federal government officials that affect the timing of technology procurement. |

Reductions in revenue in a particular quarter could lead to lower profitability in that quarter because a relatively large amount of our expenses are fixed in the short term. We incur significant operating expenses during the start-up and early stages of large contracts, and may not receive corresponding payments in that same quarter. We may also incur significant or unanticipated expenses when a contract expires, terminates or is not renewed.

We will be liable for products and service failures to our customers.

We create, implement and maintain information technology and technical services solutions that are often critical to our customers’ operations. We have experienced and, may in the future experience, some systems and service failures, schedule or delivery delays and other problems in connection with our work. If our solutions, services, products or other applications have significant defects or errors, are subject to delivery delays or fail to meet our customers’ expectations, we may:

| • | lose revenue due to adverse customer reaction; |

18

Table of Contents

| • | be required to provide additional services to a customer at no charge; |

| • | receive negative publicity, which could damage our reputation and adversely affect our ability to attract or retain customers; and |

| • | suffer claims for substantial damages against us. |

In addition, these failures may result in increased costs or loss of revenue if they result in customers postponing subsequently scheduled work or canceling or failing to renew contracts.

While many of our contracts with the federal government limit our liability for damages that may arise from negligence in rendering services, we cannot be sure that these contractual provisions will protect us from liability for damages if we are sued. Furthermore, our errors and omissions and product liability insurance coverage may not continue to be available on reasonable terms or in sufficient amounts to cover one or more large claims, or the insurer may disclaim coverage as to some types of future claims. The successful assertion of any large claim against us could seriously harm our business. Even if not successful, these claims could result in significant legal and other costs and may be a distraction to our management and may harm our reputation.

Security breaches in classified government systems could adversely affect our business.

Many of the programs we support and systems we develop, install and maintain involve managing and protecting intelligence, national security and other classified government information. While we have designed programs to comply with relevant security laws, regulations and restrictions, a security breach in one of these systems could cause serious harm to our business, damage our reputation and prevent us from being eligible for further work on critical classified systems for federal government customers. Losses that we could incur from such a security breach could exceed the policy limits that we have for our errors and omissions or product liability insurance. Damage to our reputation or limitations on our eligibility for additional work resulting from a security breach in one of the systems we develop, install and maintain could materially reduce our revenue.

Our employees or subcontractors may engage in misconduct or other improper activities, which could cause us to lose contracts.

We are exposed to the risk that employee or subcontractor fraud or other misconduct could occur. Misconduct by our employees, or those of our subcontractors, could include intentional failure to comply with federal government procurement regulations, engaging in unauthorized activities or falsifying time records. Such misconduct could also involve the improper use of our clients’ sensitive or classified information as well as security breaches, which could result in regulatory sanctions against us, liability to third parties, adverse publicity and serious harm to our reputation and could result in a loss of contracts and a reduction in revenue and net income. It is not always possible to deter individual misconduct, and the precautions we take to prevent and detect this activity may not be effective in controlling unknown or unmanaged risks or losses, which could cause us to lose contracts or cause a reduction in revenue.

Our business depends upon obtaining and maintaining required security clearances.

Many of our federal government contracts require our employees to maintain various levels of security clearances, and we are required to maintain certain facility security clearances complying with Department of Defense and the Intelligence Community requirements. Obtaining and maintaining security clearances for employees involve lengthy processes, and it is difficult to identify, recruit and retain employees who already hold security clearances. If our employees are unable to obtain or retain security clearances or if our employees who hold security clearances terminate employment with us and we are unable to find replacements with equal or greater security clearances, the customer whose work requires cleared employees could terminate the contract or decide not to renew it upon its expiration. In addition, we expect that many of the contracts on which we will bid will require us to demonstrate our ability to obtain facility security clearances and perform work with employees who hold specified types of security clearances. To the extent we are not able to obtain facility security clearances or engage employees with the required security clearances for a particular contract, we may not be able to bid on or win new contracts, or effectively re-bid on expiring contracts.

19

Table of Contents

Section 404 of the Sarbanes-Oxley Act of 2002 will require us to document and test our internal control over financial reporting for 2010 and beyond and will require an independent registered public accounting firm to report on the effectiveness of these controls. Any delays or difficulty in satisfying these requirements could adversely affect our future results of operations and our stock price.

Section 404 of the Sarbanes-Oxley Act of 2002 will require us to document and test the effectiveness of our internal control over financial reporting in accordance with an established internal control framework and to report on our conclusions as to the effectiveness of our internal controls. It will also require an independent registered public accounting firm to test our internal control over financial reporting and report on the effectiveness of such controls for our year ending December 31, 2010 and subsequent years. In addition, upon completion of this offering, we will be required under the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, to maintain disclosure controls and procedures and internal control over financial reporting. In May 2009, our independent registered accounting firm noted a material weakness in our internal control over financial reporting related to our lack of expertise and knowledge of GAAP and SEC reporting requirements. While we believe we have addressed the concern through the hiring of James Allen, as our Executive Vice President and Chief Financial Officer, and the retention of additional qualified accounting personnel, we will not know for certain whether we have remediated this issue before the completion of the audit of our 2009 consolidated financial statements.

In addition, we may in the future discover areas of our internal controls that need improvement, particularly with respect to businesses that we may acquire. If so, we cannot be certain that any remedial measures we take will ensure that we have adequate internal controls over our financial processes and reporting in the future. Any failure to implement required new or improved controls, or difficulties encountered in their implementation could harm our operating results or cause us to fail to meet our reporting obligations. If we are unable to conclude that we have effective internal control over financial reporting, or if our independent registered public accounting firm is unable to provide us with an unqualified report regarding the effectiveness of our internal control over financial reporting as of December 31, 2010 and in future periods, investors could lose confidence in the reliability of our financial statements. This could result in a decrease in the value of our common stock. Failure to comply with Section 404 could potentially subject us to sanctions or investigations by the SEC, the Nasdaq Global Market or other regulatory authorities.

If our subcontractors or suppliers fail to perform their contractor obligations, our performance and reputation as a prime contractor and our ability to obtain future business could suffer.

As a prime contractor, we often rely significantly upon other companies as subcontractors to perform work we are contractually obligated to perform for our clients. We are responsible for the work performed by our subcontractors, even though in some cases we have limited involvement in that work. If one or more of our subcontractors fail to satisfactorily perform the agreed-upon services on a timely basis or violate federal government contracting policies, laws or regulations, our ability to perform our obligations as a prime contractor or meet our clients’ expectations may be compromised. In extreme cases, failure to perform or other deficiencies on the part of our subcontractors could result in a client terminating our contract for default. A termination for default could expose us to liability, including liability for the agency’s costs of reprocurement, could damage our reputation and could hurt our ability to compete for future contracts.

Acquisitions could result in operating difficulties or other adverse consequences to our business.

One of our key operating strategies is to selectively pursue acquisitions. Our acquisition strategy poses many risks, including:

| • | we may not be able to identify suitable acquisition candidates at prices we consider attractive; |

| • | we may not be able to compete successfully for identified acquisition candidates, complete acquisitions or accurately estimate the financial effect of acquisitions on our business; |

| • | future acquisitions may require us to issue common stock or spend significant cash, resulting in dilution of ownership or additional debt leverage; |

20

Table of Contents

| • | we may have difficulty retaining an acquired company’s key employees or customers; |

| • | we may have difficulty integrating acquired businesses, resulting in unforeseen difficulties, such as incompatible accounting, information management, or other control systems; |

| • | acquisitions may disrupt our business or distract our management from other responsibilities; and |

| • | as a result of an acquisition, we may need to record write-downs from future impairments of intangible assets, which could reduce our future reported earnings. |

In connection with any acquisition that we make, there may be liabilities that we fail to discover or that we inadequately assess. Acquired entities may not operate profitably or result in improved operating performance. Additionally, we may not realize anticipated synergies. If our acquisitions perform poorly, our business and financial results could be adversely affected.