Attached files

| file | filename |

|---|---|

| 8-K - OGE ENERGY CORP. 8-K 10-21-09 - OGE ENERGY CORP. | oge8k102109.htm |

| EX-99.01 - OGE EXHIBIT 99.01 - OGE ENERGY CORP. | exhibit9901oge8k.htm |

Exhibit 99.02

BEFORE THE

CORPORATION COMMISSION OF THE STATE OF OKLAHOMA

IN THE MATTER OF THE APPLICATION OF )

OKLAHOMA GAS AND ELECTRIC COMPANY )

FOR AN ORDER GRANTING PRE-APPROVAL ) CAUSE NO. PUD 200900167

TO CONSTRUCT THE OU SPIRIT WIND FARM, )

AUTHORIZING A RECOVERY RIDER, )

AND APPROVING PHASE II AGREEMENT )

WITH THE UNIVERSITY OF OKLAHOMA )

JOINT STIPULATION AND SETTLEMENT AGREEMENT

October 15, 2009

I. Introduction

The undersigned parties believe it is in the public interest to effectuate a settlement of the issues in Cause No. PUD 200900167.

Therefore, now the undersigned parties to the above entitled cause present the following Joint Stipulation and Settlement Agreement (“Joint Stipulation”) for the Commission’s review and approval as their compromise and settlement of all issues in this proceeding between

the parties to this Joint Stipulation (“Stipulating Parties”). The Stipulating Parties represent to the Commission that the Joint Stipulation represents a fair, just, and reasonable settlement of these issues, that the terms and conditions of the Joint Stipulation are in the public interest, and the Stipulating Parties urge the Commission to issue an Order in this Cause adopting this Joint Stipulation.

The Stipulating Parties agree that the Commission has jurisdiction with respect to the issues presented in this proceeding by virtue of Article IX, §18 et seq. of the Oklahoma Constitution, 17 O.S. §152, 17 O.S. §286(C), the Commission’s Rules of Practice (OAC

165:5), and the Commission’s Electric Utility Rules (OAC 165:35).

It is hereby stipulated and agreed by and between the Stipulating Parties as follows:

II. Stipulated Facts

A. On July 30, 2009, OG&E filed an application in this cause asking that the Commission: (i) grant approval of Phase II of a Renewable Energy Program Agreement (“OU Agreement”) with the Board of Regents of the University of Oklahoma (“University”) to

allow OG&E to sell renewable energy credits (“RECs”) to the University and pass the revenues associated with such RECs through various riders; (ii) grant pre-approval of the OU Spirit Wind Farm (“OU Spirit”) and its associated costs and determine that OU Spirit is a prudent investment

Joint Stipulation & Settlement Agreement

Cause No. PUD 200000167

Page 2 of 6

and, when constructed and placed in service, will be used and useful; and (iii) authorize the recovery of costs

associated with OU Spirit through a rider and allow such a rider to be effective until OG&E’s next general rate case and implementation of new rates.

B. OU Spirit is a 101.2 MW wind-powered electric generation facility located in Woodward, Oklahoma. The OU Spirit facilities consist of 44 IEC Class IIA SWT-2.3-93 (2.3 MW and a 93-meter rotor diameter) wind turbine generators to be provided by Siemens Power

Generation, Inc. (“Siemens”). Each turbine will be supported by an 80-meter tower (262 feet) and will be connected to an underground collection system that terminates in a collector substation. OU Spirit was named by the University under a right granted by the OU Agreement. The OU Agreement also provides for, among other things, the sale of RECs from the wind farm to the University, enabling the University to meet certain commitments that it has made to rely on renewable

energy.

III. Settlement Agreement

A. The Stipulating Parties request that the Commission issue an order granting pre-approval of OU Spirit and finding that OU Spirit is a prudent investment and, when constructed and placed in service, will be used and useful to OG&E’s customers unless there is a material

variance from expected operations as presented in the pre-filed testimony of OG&E’s witnesses in this cause. The Stipulating Parties also request that the Commission approve Phase II of the OU Agreement, which will allow for the sale of RECs to the University. REC revenues generated from these sales will be passed through to OG&E’s customers as agreed to below. Finally, the Stipulating Parties request that the Commission authorize the recovery of costs associated

with OU Spirit through a recovery rider (“OU Spirit Rider,” which is attached hereto as Stipulation Exhibit RDW-1) that will become effective in accordance with the final order approving this Joint Stipulation.

B. The Stipulating Parties agree that, for purposes of the OU Spirit Rider, OG&E’s construction costs for which it is entitled recovery shall be capped at $270 million (“Capped Investment Amount”) inclusive of environmental costs as referenced in OG&E’s

direct testimony and exclusive of any reduction or credit provided in Section III.D below. O&M expense will be capped at the amounts contained in Exhibit RDW-2R (as revised and attached hereto as Stipulation Exhibit RDW-2) until rates are implemented after the next general rate case.

C. To the extent OG&E’s total investment in OU Spirit might exceed the Capped Investment Amount, OG&E shall be entitled to offer evidence and seek to establish that the excess above the Capped Investment Amount was prudently incurred and should be included in

OG&E’s rate base. Any construction costs incurred by OG&E in excess of the Capped Investment Amount shall not include interim carrying costs on the Plant in Service and will not be eligible for cost recovery until the next general rate case.

D. If OG&E is able to secure from the turbine manufacturer any reduction in costs or receive any credit related to OU Spirit, OG&E shall flow-through any of such realized reduction

Joint Stipulation & Settlement Agreement

Cause No. PUD 200000167

Page 3 of 6

or credit to customers through the OU Spirit Rider as a credit to the annual revenue requirement for 2010.

E. The Stipulating Parties agree that OG&E shall pass through to Oklahoma retail customers 100 percent of the Oklahoma jurisdictional REC revenues generated by OU Spirit RECs sold to the University, including all additional revenues which OG&E receives in the event

OU sells RECs for a profit pursuant to Paragraph 3.3 of the OU Agreement. The Oklahoma jurisdictional portion of the REC proceeds will be determined by utilizing the same allocation method used in developing the OU Spirit revenue requirement for the rider proposed in this Joint Stipulation. It is the intent of the Stipulating Parties that this pass-through of REC revenues will continue for the duration of the OU Agreement and will initially be accomplished until the completion of OG&E’s

next general rate case by having 80 percent credited to OG&E’s retail customers through the Renewable Transmission System Additions (“RTSA”) rider and the remaining 20 percent credited to OG&E’s retail customers through the OU Spirit Rider.

F. The Stipulating Parties agree that OG&E shall credit Oklahoma retail customers 80 percent of the Oklahoma jurisdictional REC revenues generated by OU Spirit RECs sold to entities other than the University by means of the RTSA rider.

G. The Stipulating Parties further intend that, at the next general rate case, the OU Spirit REC revenues described in Paragraphs E and F above will be credited to OG&E’s retail customers under a new rider (“OU REC Rider”).

H. The Stipulating Parties agree that, to the extent that OU Spirit makes additional amounts of OG&E’s coal or natural gas-fired generation capacity or energy available for sale in the Southwest Power Pool’s Energy Imbalance Service (“EIS”) market, all

revenues associated with these increased EIS market sales will continue to be credited to OG&E’s customers.

I. The Stipulating Parties agree that, except as otherwise provided herein, OG&E will not seek Commission preapproval for the construction or acquisition of any new generation asset or for a long term purchase power agreement until such time as the Commission completes

RM 200900002; provided that this restriction does not apply to: (i) an application for preapproval of any contract resulting from OG&E’s current Wind RFP process; (ii) an application for preapproval of a generation project, acquisition or long term purchase power agreement which was the subject of a competitive bid process conducted pursuant to current rules, including but not limited to a contract with any successful bidder from a new Wind RFP; or (iii) an application for preapproval of a generation

project, acquisition or long term purchase power agreement which was granted a waiver from the current competitive bid rules by the OCC; and further provided that OG&E will not be bound by this restriction if RM 200900002 has not been completed by July 1, 2010. The Stipulating Parties agree that an application seeking waiver of the competitive bid rules pursuant to the previous sentence may be processed under OAC 165:5-9-3.

J. Within thirty (30) days after Commission approval of this Joint Stipulation, OG&E agrees to file a request for a rulemaking supporting a permanent change to the

Joint Stipulation & Settlement Agreement

Cause No. PUD 200000167

Page 4 of 6

Commission’s IRP rules so that there can be a more collaborative stakeholder process in IRP submittals for electric utilities. In addition to the public meeting provided for in OAC 165:35-37-3, the Stipulating Parties will support changes to the rules that create two collaborative technical conferences for all stakeholders before the final IRP is submitted to the Commission. The Stipulating Parties also agree to support

changes to the rules that require electric utilities to: (i) provide a facilitator to coordinate and assist the stakeholder group in its discussions at the technical conferences; (ii) empower such facilitator to prepare meeting minutes from the technical conferences; and (iii) direct the facilitator to prepare a summary of stakeholder input for inclusion as an exhibit in the draft and final IRP.

K. The Stipulating Parties agree that OG&E will refrain from initiating any new RFP process for new wind generation until after OG&E finalizes and submits an Integrated Resource Plan (“IRP”) in January 2010. For purposes of OG&E’s January

2010 IRP submittal, the Stipulating Parties further agree that OG&E will, in addition to any requirements of OAC 165:35-37-3, hold a collaborative technical conference for all stakeholders during the first two weeks of December 2009 in order to allow all stakeholders the opportunity to review and provide input at that technical conference regarding utility objectives, assumptions, and planning scenarios contained in the draft IRP. The Stipulating Parties agree that OG&E shall pay for and be

able to recover costs associated with third party consultants needed by the Attorney General and/or the Commission Staff to review the upcoming draft IRP and participate in the December 2009 stakeholder technical conference. This provision is not intended to relieve OG&E of its burden of proof to demonstrate that any new agreements it enters into to acquire wind energy assets or to purchase wind energy, including any agreements resulting from the Company’s current Wind Energy RFP, are reasonable

and prudent.

IV. General Reservations.

The Stipulating Parties represent and agree that, except as specifically provided:

A. Negotiated Settlement. This Joint Stipulation represents a negotiated settlement for the purpose of compromising and resolving the issues

presented in this Cause.

B. Authority to Execute. Each of the undersigned counsel of record affirmatively represents to the Commission that he or she has fully advised his or her respective clients(s) that the execution

of this Joint Stipulation constitutes a resolution of issues which were raised in this proceeding; that no promise, inducement or agreement not herein expressed has been made to any Stipulating Party; that this Joint Stipulation constitutes the entire agreement between and among the Stipulating Parties; and each of the undersigned counsel of record affirmatively represents that he or she has full authority to execute this Joint Stipulation on behalf of his or her client(s).

C. Balance/Compromise of Positions. The Stipulating Parties stipulate and agree that the agreements contained in this Stipulation have resulted from negotiations among the Stipulating Parties. The

Stipulating Parties hereto specifically state and recognize that this Joint

Joint Stipulation & Settlement Agreement

Cause No. PUD 200000167

Page 5 of 6

Stipulation represents a balancing of positions of each of the Stipulating Parties in consideration for the agreements and commitments made by the other Stipulating Parties in connection therewith. Therefore, in the event that the Commission does not approve and adopt all of the terms of this Joint Stipulation, this Joint Stipulation shall be void and of no force and effect,

and no Stipulating Party shall be bound by the agreements or provisions contained herein. The Stipulating Parties agree that neither this Joint Stipulation nor any of the provisions hereof shall become effective unless and until the Commission shall have entered an Order approving all of the terms and provisions as agreed to by the parties to this Joint Stipulation.

D. Admissions and Waivers. The Stipulating Parties agree and represent that the provisions of this Joint Stipulation are intended to relate only to the specific matters referred to herein, and by

agreeing to this settlement, no Stipulating Party waives any claim or right which it may otherwise have with respect to any matters not expressly provided for herein. In addition, none of the signatories hereto shall be deemed to have approved or acquiesced in any ratemaking principle, valuation method, cost of service determination, depreciation principle or cost allocation method underlying or allegedly underlying any of the information submitted by the parties to this Cause and except as specifically

provided in this Joint Stipulation, nothing contained herein shall constitute an admission by any Stipulating Party that any allegation or contention in this proceeding is true or valid or shall constitute a determination by the Commission as to the merits of any allegations or contentions made in this proceeding.

E. No Precedential Value. The Stipulating Parties agree that the provisions of this Joint Stipulation are the result of negotiations

based upon the unique circumstances currently represented by the Applicant and that the processing of this Cause sets no precedent for any future causes that the Applicant or others may file with this Commission. The Stipulating Parties further agree and represent that neither this Joint Stipulation nor any Commission order approving the same shall constitute or be cited as precedent or deemed an admission by any Stipulating Party in any other proceeding except as necessary to enforce its terms before

the Commission or any court of competent jurisdiction. The Commission’s decision, if it enters an order approving this Joint Stipulation, will be binding as to the matters decided regarding the issues described in this Joint Stipulation, but the decision will not be binding with respect to similar issues that might arise in other proceedings. A Stipulating Party’s support of this Joint Stipulation may differ from its position or testimony in other causes. To the extent

there is a difference, the Stipulating Parties are not waiving their positions in other causes. Because this is a stipulated agreement, the Stipulating Parties are under no obligation to take the same position as set out in this Joint Stipulation in other dockets.

F. Discovery. As between and among the Stipulating Parties, any pending requests for information or discovery and any motions that

may be pending before the Commission are hereby withdrawn.

Joint Stipulation & Settlement Agreement

Cause No. PUD 200000167

Page 6 of 6

WHEREFORE, the Stipulating Parties hereby submit this Joint Stipulation and Settlement Agreement to the Commission as their negotiated settlement of this proceeding with respect to all issues raised within the Application filed herein by Oklahoma Gas & Electric Company or by Stipulating Parties to this Cause, and respectfully

request the Commission to issue an Order approving the recommendations of this Joint Stipulation and Settlement Agreement.

| OKLAHOMA GAS & ELECTRIC COMPANY | |||

| Dated: 10/15/2009 | By: | /s/ William J. Bullard | |

| William J. Bullard | |||

| OKLAHOMA OFFICE OF THE ATTORNEY GENERAL | |||

| Dated: 10/15/2009 | By: | /s/ William L. Humes | |

| William L. Humes | |||

| OKLAHOMA INDUSTRIAL ENERGY CONSUMERS | |||

| Dated: 10/15/2009 | By: | /s/ Thomas P. Schroedter | |

| Thomas P. Schroedter | |||

| OG&E SHAREHOLDERS ASSOCIATION | |||

| Dated: 10/15/2009 | By: | /s/ Ronald E. Stakem | |

| Ronald E. Stakem | |||

*Staff supports all terms of this document except for subsection III, paragraph J, where Staff takes no position at this time.

| PUBLIC UTILITY DIVISION | |||

| OKLAHOMA CORPORATION COMMISSION | |||

| Dated: 10/15/2009 | By: | /s/ Andrew Tevington | |

| Andrew Tevington | |||

| Deputy Director | |||

Stipulation

Exhibit RDW-1

Page 1 of 3

OKLAHOMA GAS AND ELECTRIC COMPANY Original

Sheet No. __________

P. O. Box 321 Date

Issued ___________

Oklahoma City, Oklahoma 73101

STANDARD PRICING SCHEDULE: OU SPIRIT

STATE OF OKLAHOMA

OU SPIRIT RIDER

EFFECTIVE IN/DATE: All territory served, provided however that this rider will not be in effect until approved by the Commission and as individual wind turbines are operational.

OU SPIRIT OKLAHOMA JURISDICTIONAL

PORTION OF 101.2 MW WIND PROJECT

APPLICABILITY: The annual rider will recover from Oklahoma retail jurisdictional customers the following Oklahoma Retail Jurisdictional Portion (86.0495%) of the OU Spirit project revenue requirement determined by the following: rate of return (ROR) on rate

base plus income taxes, depreciation, ad valorem tax, and O&M expense associated with OU Spirit. The ROR on the OU Spirit project will be the ROR specified and approved in OG&E’s PUD 200500151 general rate case. The Oklahoma jurisdiction revenue requirement is allocated between customer classes on a 1CP Average and Excess (1CP A&E) production allocator. This rider is applicable to all Oklahoma retail rate classes and customers except those specifically exempted by special

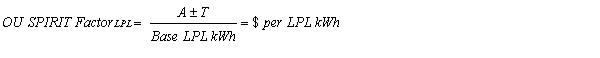

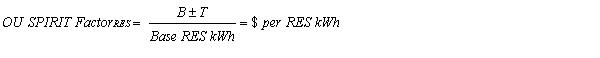

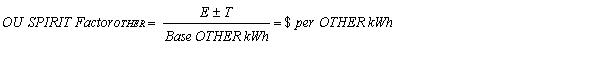

contract. The OU Spirit Factor calculates the rider’s annual charges per kilowatt-hour (kWh) by class using the following formulas:

Public Utilities Division Stamp

Rates Authorized by the Oklahoma Corporation Commission:

| (Effective) | (Order No.) | (Cause/Docket No.) |

Stipulation Exhibit RDW-1

Page 2 of 3

OKLAHOMA GAS AND ELECTRIC COMPANY Original

Sheet No. __________

P. O. Box 321 Date

Issued ___________

Oklahoma City, Oklahoma 73101

STANDARD PRICING SCHEDULE: OU SPIRIT

STATE OF OKLAHOMA

OU SPIRIT RIDER

Where:

|

A = Oklahoma LPL Class Annual |

Base LPL kWh = Applicable Oklahoma |

|

Jurisdictional Revenue Requirement |

Annual Jurisdictional LPL Retail kWh Sales |

|

approved in yearly update filing | |

|

B = Oklahoma RES Class Annual |

Base RES kWh = Applicable Oklahoma |

|

Jurisdictional Revenue Requirement |

Annual Jurisdictional LPL Retail kWh Sales |

|

approved in yearly update filing | |

|

C = Oklahoma GS Class Annual |

Base GS kWh = Applicable Oklahoma |

|

Jurisdictional Revenue Requirement |

Annual Jurisdictional LPL Retail kWh Sales |

|

approved in yearly update filing | |

|

D = Oklahoma PL Class Annual |

Base PL kWh = Applicable Oklahoma |

|

Jurisdictional Revenue Requirement |

Annual Jurisdictional LPL Retail kWh Sales |

|

approved in yearly update filing | |

|

E = Oklahoma OTHER Class Annual |

Base OTHER kWh = Applicable Oklahoma |

|

Jurisdictional Revenue Requirement |

Annual Jurisdictional OTHER Retail kWh |

|

Sales approved in yearly update filing. The | |

|

kWh is a composite of the annual kWh of the | |

|

non major Oklahoma Retail Classes. | |

|

T= Class True-up amount from previous |

At the conclusion of the OU Spirit rider, any |

|

periods |

over or under true-up amount shall be |

|

included in the Fuel Clause Adjustment for | |

|

credit or collection from retail customers |

Interim factors by Class will be calculated for the last few months of 2009 and based upon the estimated monthly revenue requirements by class and using expected class kWh for the month in which the factors are to be applied. Annual factors will be determined for the 2010 and 2011 timeframe with applicable true-up

for each timeframe.

BASE kWh: is the applicable Oklahoma Jurisdictional kWh as determined by the Company computed using either a test year approved kWh or the most current twelve (12) billing month kWhs (weather adjusted) and submitted for approval of the Commission in

November of each year.

Public Utilities Division Stamp

Rates Authorized by the Oklahoma Corporation Commission:

| (Effective) | (Order No.) | (Cause/Docket No.) |

Stipulation Exhibit RDW-1

Page 3 of 3

OKLAHOMA GAS AND ELECTRIC COMPANY Original

Sheet No. __________

P. O. Box 321 Date

Issued ___________

Oklahoma City, Oklahoma 73101

STANDARD PRICING SCHEDULE: OU SPIRIT

STATE OF OKLAHOMA

OU SPIRIT RIDER

TRUE-UP: is the over or under amount which will be the difference between the revenues collected through the rider from a previous period and the Oklahoma Actual Revenue Requirements of that period determined by yearly Commission review. Renewable

Energy Credit (REC) revenues shall be credited to customers in accordance with the FCA, GPWR, or RTSA as appropriate and as specified within each of those respective riders. In addition, the OU Spirit Rider true-up will include an additional credit to customers for twenty (20) percent of any revenues received from the Oklahoma retail portion of OU Spirit REC sales to the University of Oklahoma. The credit will be allocated on the same basis that determines each customer class’ contribution to

the Oklahoma jurisdictional revenue requirement. All true-up amounts for any previous period will be added to or subtracted from the expected Oklahoma Retail Jurisdictional amount by Class or “Other” for the next calendar year collection.

TERM: This rider shall terminate at the end of revenue year 2011 or upon the implementation of new rates from OG&E’s next general rate review (whichever is earlier) and will be subject to annual True-Up adjustments and annual Commission

audits.

DETERMINATION OF THE REVENUE REQUIREMENT: The total revenue requirement shall be based upon the ROR on rate base plus income taxes, O&M expense, depreciation expense, ad valorem tax, and production tax credits. REC revenues

associated with the OU Spirit wind project will be credited to customers through the FCA, the RTSA and the true-up contained herein.

Project Revenue

Revenue Requirement

Without REC Offset Oklahoma

Jurisdiction

Interim 2009 TBD TBD

Year 2010 $27,352,111 $23,536,355*

Year 2011 $24,635,519 $21,198,741

* If OG&E secures any credit from its turbine manufacturer related to OU Spirit, the Oklahoma retail customers’ jurisdictional revenue requirement in 2010 will be reduced by their share of such credit.

Public Utilities Division Stamp

Rates Authorized by the Oklahoma Corporation Commission:

| (Effective) | (Order No.) | (Cause/Docket No.) | |

| Stipulation | ||||

|

Exhibit RDW-2 | ||||

|

Estimated Revenue Requirement for OU Spirit Wind Farm | ||||

|

Annualized Amounts | ||||

|

2010 |

2011 | |||

|

Rate Base |

||||

|

1 |

Utility Plant (Cap X) |

270,000,000 |

270,000,000 | |

|

2 |

Accumulated Provision for Depreciation |

(4,950,000) |

(15,750,000) | |

|

3 |

Accumulated Deferred Income Taxes |

(47,156,148) |

(53,760,123) | |

|

4 |

Total Rate Base * |

217,893,852 |

200,489,877 | |

|

5 |

Return on Rate Base * |

26,888,934 |

24,741,217 | |

|

Expenses |

||||

|

6 |

O&M Expenses |

2,731,773 |

2,769,383 | |

|

7 |

Depreciation Expense |

10,800,000 |

10,800,000 | |

|

8 |

Ad Valorem Taxes |

2,700,000 |

2,700,000 | |

|

9 |

Total Expenses |

16,231,773 |

16,269,383 | |

|

10 |

Less: Production Tax Credits (PTC’s) |

(15,768,596) |

(16,375,081) | |

|

11 |

Total Revenue Requirement (Ln 5 + Ln 9 + Ln 10) |

27,352,111 |

24,635,519 | |

|

12 |

Oklahoma Jurisdictional % |

86.0495% |

86.0495% | |

|

13 |

Oklahoma Revenue Requirement |

23,536,355 |

21,198,741 | |

|

14 |

Offset from sale of REC’s** |

(1,227,891) |

(1,959,687) | |

|

15 |

Adjusted Oklahoma Revenue Requirement |

22,308,464 |

19,239,053 | |

|

* |

Return on rate base is based on approved 12.34% tax adjusted rate in PUD 200500151. Return was calculated monthly based on monthly rate base balances. | |||

|

** |

Subject to adjustment in future rate proceedings. |

|||