Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INTEGRAL SYSTEMS INC /MD/ | d8k.htm |

FALL 2009 Exhibit 99.1 |

2 SAFE HARBOR INTEGRAL SYSTEMS • This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act. Such forward-looking statements include, but are not necessarily

limited to, our anticipated financial performance, business prospects, technological

developments, new products, research and development activities and similar

statements concerning anticipated future events and expectations that are not historical facts. • These forward-looking statements are based on current information and expectations. We caution you that these statements are not guarantees of future performance and are subject to numerous risks and uncertainties, including our reliance on contracts and subcontracts funded by the U.S. government, intense competition in the ground systems industry, the competitive bidding process to which our government and commercial contracts are subject, our dependence on the satellite industry for most of our revenues, rapid technological changes in the satellite industry, our acquisition strategy and other risks and uncertainties noted in

our Securities and Exchange Commission filings, including our Annual Report on Form 10-K for the year ended September 30, 2008, and subsequent filings. We

undertake no obligation to publicly update or revise any forward-looking statement,

whether as a result of new information, future events or otherwise. |

3 OUR VISION To be the market leader in providing integrated solutions for satellite and terrestrial networks INTEGRAL SYSTEMS |

4 INTEGRAL SYSTEMS AT A GLANCE • NasdaqGS: ISYS • Founded: 1982 • Est. FY2009 Sales: $164.0 million • Est. FY2009 Earnings: $2.9 million/$0.15 per diluted share • Employees: 600 employees - 13 Locations in five countries U.S. SBA Region III Contractor of the Year, 2009 Washington Post Top 200 Companies, 2009 Forbes Top 200 Small Companies in America, 2008 |

5 INTEGRAL SYSTEMS BUSINESS APPROACH World Class Systems Engineering Best-In-Class Commercial Product-Based Solutions Back to Basics •Disciplined Investment in R&D and B&P •Reduction of Indirect and Unallowable Costs •Improved Communications •Improved Forecasting •Renewed Focus on Core Business Improved Performance •Emphasis on Backlog Growth & Gross Margin •Reasonable Organic Growth •Strategic Acquisitions •Focus on Next Nearest Market Opportunities -Other Military Services -Managed Services -Network: Design, Installation, Operation

|

6 CUSTOMER COMMITMENT Our Commitment to Customer Service… Integral Systems Has Supported 250+ Satellite Missions INTEGRAL SYSTEMS |

7

ALIGNED OPERATIONS INTEGRAL SYSTEMS Military & Intelligence Civil & Commercial Products Services • US Air Force • DISA • Intelligence • NASA • NOAA • Commercial Operators • International • U.S. Military • Satellite Operators • Network Operators • Commercial and government satellite operators • Space Situational Awareness • U.S. Army, U.S. Navy • NATO • Antenna/RF systems integration • Leverage footprint • DHS • Military Test Range • Interference detection, characterization, and geolocation • Satellite communications managed services • Technical support |

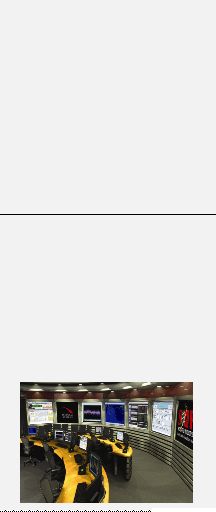

8 NOC Toulouse NOC C. Springs UK UAE Hawaii Singapore Brazil Australia NOC Columbia GLOBAL OPERATIONS Current presence Future Services Expansion (Teleports) Future Network Operation Center (Services) INTEGRAL SYSTEMS |

9 SERVICE SOLUTIONS Services Offered • Network Operations Management - Network planning, resource allocation, and link optimization - Satellite transponder, network, and link Quality of Service monitoring - RF interference detection and geolocation - Service Level Agreement (SLA) validation • Technical Services & Sustainment - Remote monitoring and control of equipment at teleport & customer ground terminal facilities - Tech refresh and sustainment - Expert operations and maintenance services • Systems Integration - Low cost turn-key systems integration capabilities Rollout Strategy 1. Initial Infrastructure from current ISYS products - satID from RT Logic (geolocation) - Monics from SAT Corp. (signal monitoring) - Compass from Newpoint (network management) - Antennas purchased COTS - COTS work stations and servers 2. Global Services offered initially to existing customer through existing sales channels 3. Grow regionally as customer base evolves - Leverage current international sales channels INTEGRAL SYSTEMS |

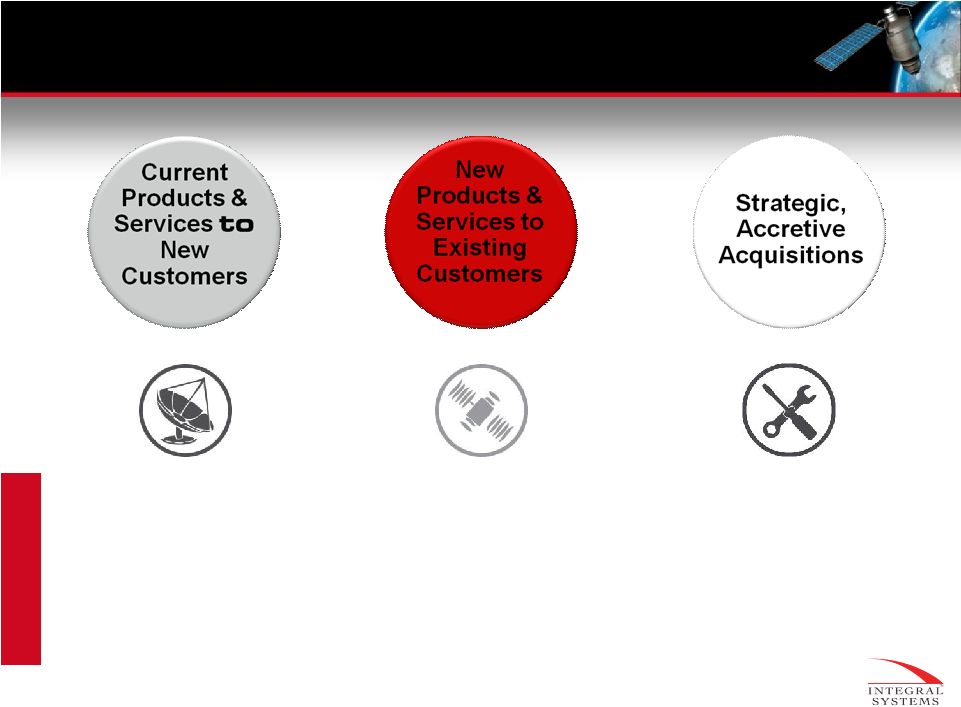

10 GROWTH STRATEGY & MARKETS • Interference Detection & Geolocation • Emerging Niche Satellite Operators • Expanded Military Footprint • Space Situational Awareness • Network Operations – Remote site monitoring – Data fusion – Payload signal processing • Managed Services – Outsourced operations management and systems monitoring – Service-level agreement/Quality of Service (QoS) management INTEGRAL SYSTEMS |

11 DIVERSIFIED GLOBAL PERSPECTIVE Recent Contract Awards: •Restructured U.S. Air Force contract for rapid attack, identification, detection (RAIDRS): $77.0M ceiling •Command and Control System –

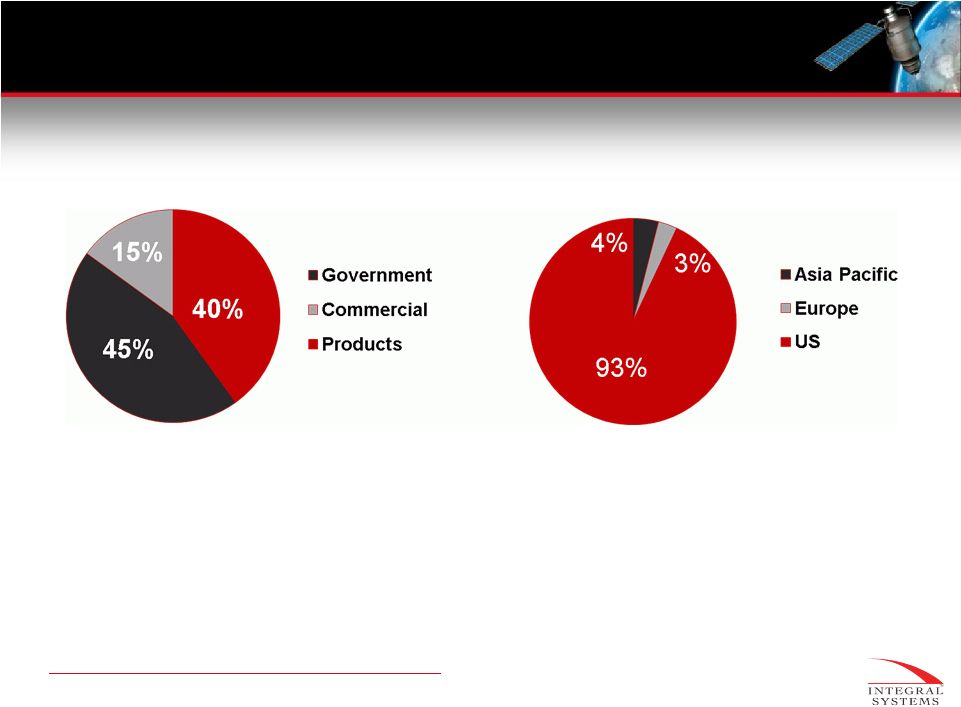

Consolidated (CCS-C): $7.5M Extended through 2011 •Hill Air Force Base: $4M new contract Key Updates: • Opened Integral Systems Europe UK in FY2009 • Expect International to represent over 10% of total revenue in FY10 • Announced 6 new/expanded contracts in Asia in FY09 totaling ~$15M *BASED UPON FY 2009 RESULTS INTEGRAL SYSTEMS SALES BY SEGMENT* SALES GEOGRAPHY* |

12 FINANCIAL OVERVIEW |

13 FY 2010 OUTLOOK & RECENT UPDATES Back to Basics Management Approach • Cost-cutting measures implemented • Aligned for growth – capitalize on installed base • Completed infrastructure investments Management Enhancement • Appointment of Paul G. Casner as President & CEO • Appointment of Maj Gen (Ret.) H. Marshal Ward as COO Business Developments • Major Air Force Contracts extended through 2011/2012 - Over $50Min new backlog • International Expansion - Approx. $15.0M in Asia in FY09 - Significant European contracts with CNES, Thales, NATO INTEGRAL SYSTEMS FY10 GUIDANCE Revenue $170M - $174M Gross Profit Margin 35% - 37% EBITDA $20M Bookings $200M Cash Flow from Operations $25M - $30M |

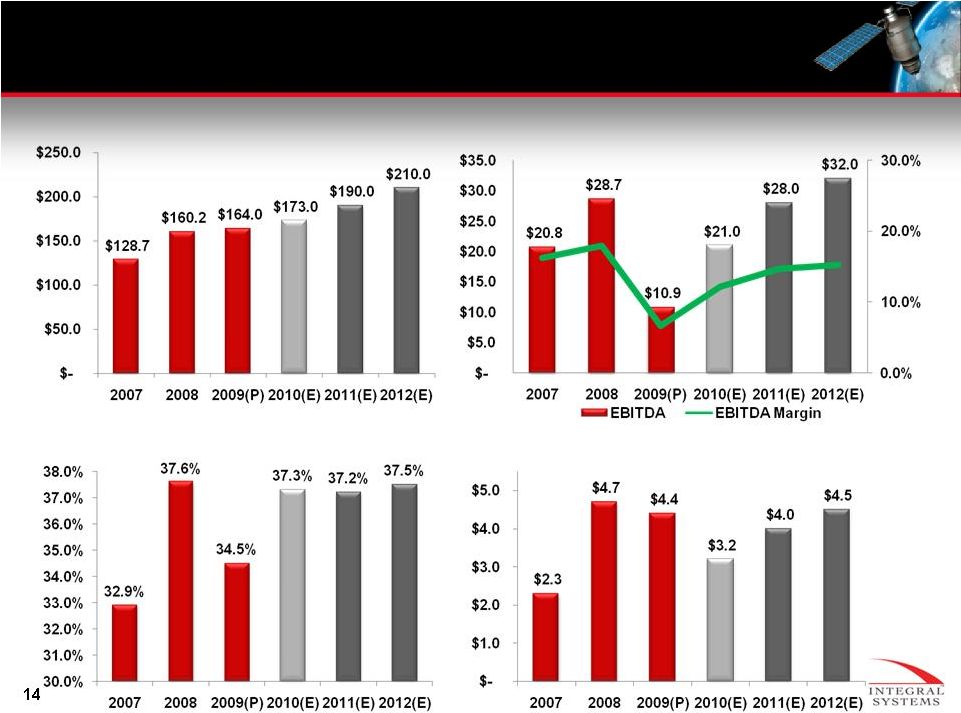

FINANCIALS REVENUE EBITDA & MARGIN GROSS PROFIT MARGIN CAPITAL EXPENDITURES INTEGRAL SYSTEMS |

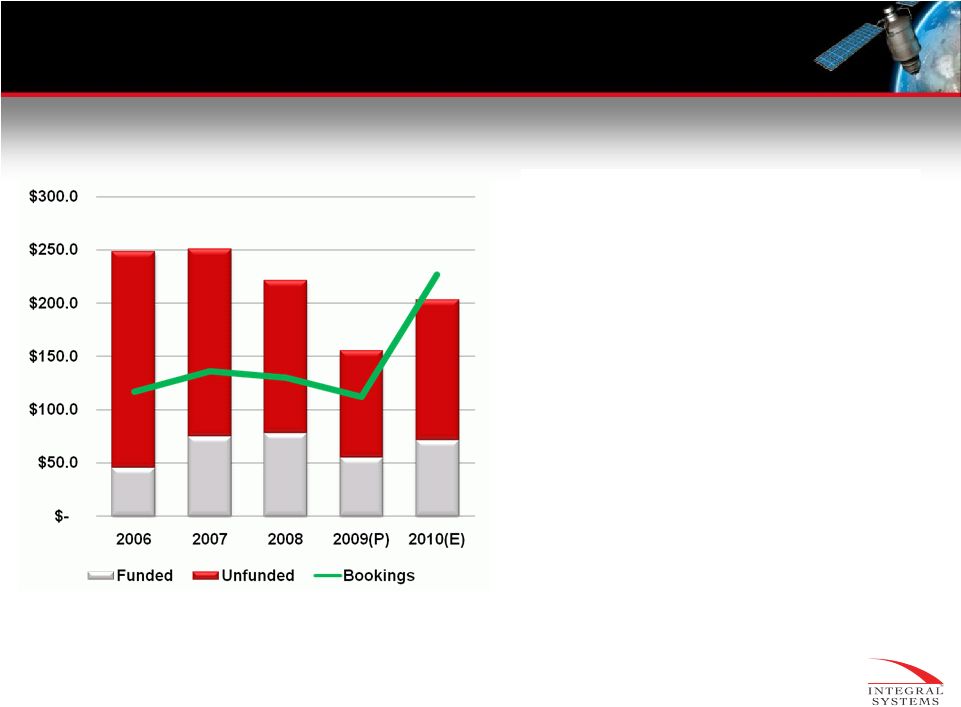

15 BOOKINGS, BACKLOG, AND PIPELINE Key Opportunities FY10 – FY12 • Space Network Ground Segment Sustainment • GPS Operational Control Segment (OCX) Phase B • Restricted Program, National Reconnaissance Office (NRO) • RAIDRS ECP 10 • Space Situational Awareness • NATO Expansion • Managed Services • Antenna and Ground System Integration (ISE UK) INTEGRAL SYSTEMS |

16 SUMMARY INTEGRAL SYSTEMS |

17 Back-Up INTEGRAL SYSTEMS |

18 Use of Non-GAAP Financial Measures INTEGRAL SYSTEMS EBITDA (earnings before interest, taxes, depreciation and amortization) is a non-GAAP

financial measure used by management to evaluate operating performance.

Management believes that the presentation of EBITDA helps management and

investors to make a meaningful comparison between our operating results and

those of other companies, as well as providing a consistent comparison of our

relative historical financial performance. The presentation of this non-GAAP financial measure is not to be considered in isolation or as a substitute for our

financial results prepared in accordance with GAAP. Below are reconciliations of fiscal years 2007 - 2012 net income to EBITDA: Fiscal Year Ended September 26, 2009 2007 2008 2009(P) 2010(E) 2011(E) 2012(E) ($ millions) Net Income $ 12.8 $ 18.2 $ 2.9 $ 8.0 $ 13.5 $ 16.0 Other Income (Expense), net (2.2) (0.3) 0.1 0.4 0.6 0.8 Provision for Income Taxes 6.3 7.1 0.1 4.5 5.5 6.2 Income From Operations $ 16.9 $ 25.0 $ 3.1 $ 12.9 $ 19.6 $ 23.0 Non-Cash Stock Compensation 0.9 1.1 3.5 3.1 3.2 3.5 Depreciation and Amortization 3.0 2.6 4.3 5.0 5.2 5.5 EBITDA $ 20.8 $ 28.7 $ 10.9 $ 21.0 $ 28.0 $ 32.0 |