Attached files

| file | filename |

|---|---|

| 8-K - VIRGIN MEDIA INC. | tp8k_virginmedia.htm |

| EX-99.4 - VIRGIN MEDIA INC. | tp8kex99_4.htm |

| EX-99.2 - VIRGIN MEDIA INC. | tp8kex99_2.htm |

| EX-99.1 - VIRGIN MEDIA INC. | tp8kex99_1.htm |

Exhibit 99.3

Amendment request

Lender presentation

October 20, 2009

Forward-looking statements

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of

1995

Various statements contained in this document constitute “forward‑looking statements” as that term is defined under the Private

Securities

Litigation Reform Act of 1995. Words like “believe,” “anticipate,” “should,” “intend,” “plan,” “will,” “expects,” “estimates,” “projects,” “positioned,”

“strategy,” and similar expressions identify these forward‑looking statements, which involve known and unknown risks, uncertainties and other

factors that may cause our actual results, performance or achievements or industry results to be materially different from those contemplated,

projected, forecasted, estimated or budgeted, whether expressed or implied, by these forward‑looking statements. These factors, among others,

include: (1) the ability to compete with a range of other communications and content providers; (2) the ability to manage customer churn; (3) the

ability to maintain and upgrade our networks in a cost-effective and timely manner; (4) the ability to implement our restructuring plan successfully

and realize the anticipated benefits; (5) the general deterioration in economic conditions; (6) the continued right to use the Virgin name and logo;

(7) possible losses in revenues due to systems failures; (8) the ability to provide attractive programming at a reasonable cost; (9) the ability to

control unauthorized access to our network; (10) the effect of technological changes on our businesses; (11) the reliance on single-source

suppliers for some equipment, software and services and third party distributors of our mobile services; (12) currency and interest rate fluctuations;

(13) the ability to fund debt service obligations through operating cash flow and refinance our debt obligations; (14) the ability to obtain additional

financing in the future; (15) the ability to comply with restrictive covenants in our indebtedness agreements; and (16) the extent to which our future

cash flow will be sufficient to cover our fixed charges.

Litigation Reform Act of 1995. Words like “believe,” “anticipate,” “should,” “intend,” “plan,” “will,” “expects,” “estimates,” “projects,” “positioned,”

“strategy,” and similar expressions identify these forward‑looking statements, which involve known and unknown risks, uncertainties and other

factors that may cause our actual results, performance or achievements or industry results to be materially different from those contemplated,

projected, forecasted, estimated or budgeted, whether expressed or implied, by these forward‑looking statements. These factors, among others,

include: (1) the ability to compete with a range of other communications and content providers; (2) the ability to manage customer churn; (3) the

ability to maintain and upgrade our networks in a cost-effective and timely manner; (4) the ability to implement our restructuring plan successfully

and realize the anticipated benefits; (5) the general deterioration in economic conditions; (6) the continued right to use the Virgin name and logo;

(7) possible losses in revenues due to systems failures; (8) the ability to provide attractive programming at a reasonable cost; (9) the ability to

control unauthorized access to our network; (10) the effect of technological changes on our businesses; (11) the reliance on single-source

suppliers for some equipment, software and services and third party distributors of our mobile services; (12) currency and interest rate fluctuations;

(13) the ability to fund debt service obligations through operating cash flow and refinance our debt obligations; (14) the ability to obtain additional

financing in the future; (15) the ability to comply with restrictive covenants in our indebtedness agreements; and (16) the extent to which our future

cash flow will be sufficient to cover our fixed charges.

These and other factors are discussed in more detail under “Risk Factors” and elsewhere in Virgin Media’s Form 10-K as filed with the SEC

February 26, 2009 and revised by our current report on Form 8-K as filed with the SEC on May 27, 2009, our Form 10-Q as filed with the SEC on

May 6, 2009 and our Form 10-Q as filed with the SEC on August 7, 2009. We assume no obligation to update our forward-looking statements to

reflect actual results, changes in assumptions or changes in factors affecting these statements.

February 26, 2009 and revised by our current report on Form 8-K as filed with the SEC on May 27, 2009, our Form 10-Q as filed with the SEC on

May 6, 2009 and our Form 10-Q as filed with the SEC on August 7, 2009. We assume no obligation to update our forward-looking statements to

reflect actual results, changes in assumptions or changes in factors affecting these statements.

Adjustment

Prior period results have been adjusted to reflect the treatment of our former sit-up business as discontinued operations and the reorganization

of

our reporting segments.

our reporting segments.

2

3

Agenda

• Business overview

• Trading performance and financing strategy

• Amendment request

• Q&A

Today’s speakers

Neil Berkett

CEO

Rick Martin

Treasurer

Our Journey

2006-2007 2007-2008 2008-2009 2009+

Consolidate

Fix Fundamentals

Differentiate Products

Grow

• Extract cable merger

synergies

synergies

• Reduce headcount

• Single cable billing and

management system

management system

• Harmonise processes

across Cable

across Cable

• Launch UK’s first quad

play offering

play offering

• Reduce churn

• Address back book issue

• Improve call answer rates

• Reduce fault rates

• Embed NPV focus across

organisation

organisation

• Start next phase of cost

savings program to align

operating structure with

strategy => £120m pa

savings by 2012

savings program to align

operating structure with

strategy => £120m pa

savings by 2012

Broadband

• Docsis 3.0 rollout

• Speed upgrades

• Value added services

Television

• Enhance VOD with BBC

iPlayer & Music

iPlayer & Music

• Free HD & ESPN from XL

TV tier

TV tier

Mobile

• Mobile broadband

• Market leading data rate

• Network expansion

• Retail

• Exploit network

advantage: more VAS,

NGTV, VOD adverts

advantage: more VAS,

NGTV, VOD adverts

• Select content

investment: HD

investment: HD

• Price rises => ARPU

growth

growth

• National

• Grow business data

4

Our priorities

Growth strategy focused on leveraging our network advantage

Continually improve product quality and reliability

Develop differentiated products to underpin value & ARPU growth

Enhance understanding of the market and our customers

Grow customer advocacy

Exploit operational leverage

On track for £120m annual P&L savings by 2012

Addressing our capital structure

Strategic

Operational

Financial

Lead next

generation

broadband

generation

broadband

Lead on-

demand TV

revolution

demand TV

revolution

Leverage mobile

as the 3rd screen

in the home

as the 3rd screen

in the home

Grow revenue and ARPU whilst keeping churn low

Address imperfections in the Regulatory Framework

Regulatory

Grow Business

data

data

5

Strong performance underscores

defensive characteristics

defensive characteristics

6

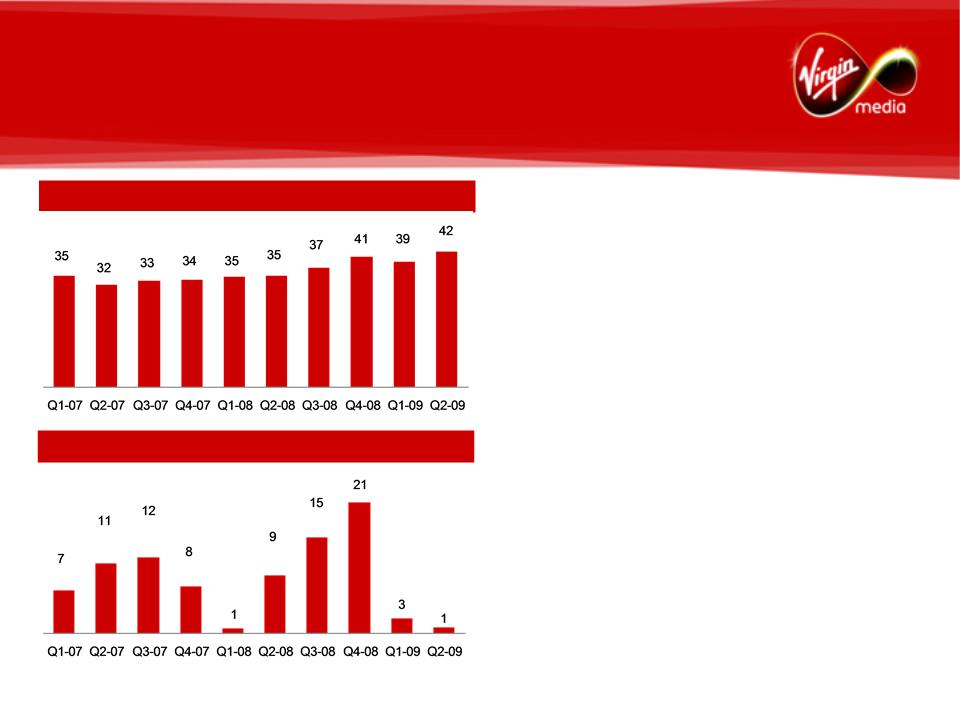

Triple play (%) and RGU(1)/customer

On-net RGUs(1) (‘000)

Monthly on-net churn (%)

1 RGUs include on-net broadband, TV and phone; 2 On-net ARPU for Q3-06 is shown before adjustment for disposal of sit-up

Broadband tier mix improving

• Investment in Docsis 3.0

– Improves quality of service

– Differentiates Virgin Media from competition

– Improves tier mix and revenue growth

7

Enriched TV content and capability

– VOD reach 55% at Q2-09 with an average of

32 views per user per month

• Significant V+ DVR growth potential from 19% penetration at Q2-09

• Content investments focused on HD

– Announced six new HD channels available free

to XL customers

• 4HD, ESPN HD, LIVING, FX, MTV Networks, National

Geographic

– Plan to launch more HD channels

– Added HD BBC iPlayer

• ESPN sports channels free to XL customers

Monthly VOD views (m)

V+ base (000s)

TV net adds

8

Continued success in contract mobile

• Contract customers up 60% in Q2-09 on Q2-08; increased market share

• Cross-sell and contract bundle opportunity

– 609k cable homes with at least one registered

mobile; 450k quad-play customers (at Q2-09)

– Churn profile improves for bundled customers

driving increased value

– Mobile contract churn in cable homes is significantly

lower than in non-cable homes

• Mix shift from prepay to contract improves value of mobile base

• New Mobile portal; Convergence opportunities

Contract customers (‘000s)

Monthly bundle churn Q2-09 (%)

9

Content overview

VMtv revenue (£m)¹

1 Before intersegment eliminations

2 Source: BARB figures for entertainment pay channels (excluding sports) year to date , weeks 1-38 2009, ranked by share of Pay TV adults viewing

Cash from UKTV (£m)

• VMtv channels include Virgin1, LIVING and Bravo

• UKTV: a 50/50 JV with BBC Worldwide with

channels including Dave and G.O.L.D. (not

consolidated)

channels including Dave and G.O.L.D. (not

consolidated)

• Virgin1 presence on Freeview to promote and cross-

sell pay-TV offerings and to increase share of ad-

sale revenue market

sell pay-TV offerings and to increase share of ad-

sale revenue market

• Channel portfolio demonstrated strong performance

– LIVING is no.2 payTV entertainment channel2

• New Sky carriage agreement for VMtv channels

concluded in November 2008

concluded in November 2008

• Additional cash contribution from UKTV

– £46m in 2008 (£38m in 2007)

10

Business services overview

Business revenue mix (£m/% of total)

• Network passes within 40m of 52% of all UK

businesses and could serve over 75% of all regional /

local authorities

businesses and could serve over 75% of all regional /

local authorities

• Targets medium-sized corporates and public sector

organizations in both retail and wholesale markets

organizations in both retail and wholesale markets

• Offering multi-site, managed network data solutions

tailored to the specific requirements of customers

tailored to the specific requirements of customers

• Strategic shift from lower margin voice to higher

margin data services

margin data services

• Continued growth in high-margin Retail Data product

lines

lines

– Data growth products include IPVPN, Ethernet

and internet services

and internet services

163

156

160

163

161

157

153

155

150

143

11

Positive policy and regulatory

developments

developments

• Government’s Digital Britain report sets framework for accelerated network

investment

investment

– Confirmed that no case for regulation of cable

network at present

– New 2Mb “universal service commitment”

and next generation access fund both

potentially provide opportunity to accelerate our network extension programme

potentially provide opportunity to accelerate our network extension programme

• Working closely with the Government on its proposals to tackle illegal file-sharing

• Significant progress in Ofcom’s investigation into pay TV

– Wholesale regime for Sky premium channels

would significantly enhance our

ability to compete

ability to compete

– Indication by Ofcom to address Sky’s

underlying advantage in the acquisition of

Premier League football and Hollywood movie rights

Premier League football and Hollywood movie rights

12

Strengthened management team

13

Bryan H. Hall

General Counsel

Neil Berkett

CEO

Andrew Barron

Chief Customer and

Operations Officer

Operations Officer

Mark Schweitzer

Chief Commercial Officer

Jeff Wollen

Executive Director of Change

Martin Wyke

Chief Technology and

Information Officer

Information Officer

1 Eamonn O'Hare will assume CFO responsibilities in November 2009

Eamonn O’Hare(1)

CFO

Elisa Nardi

Managing Director People

Investment highlights

• Disciplined focus on execution and improving fundamentals

• Superior network provides significant product and economic advantage now

and in future

and in future

– Superior 10/20/50Mb broadband offering

– Leading position in Video-On-Demand

– Leveraging mobile to cross-sell mobile contracts

into cable base

– Positioned to grow business data

• New operating model for a customer focused organisation

• Strong Free Cash Flow and deleveraging

• Continued proactive management of capital structure

14

15

Trading performance and financing strategy

Overview of financials

16

1 See Appendices for the calculation of LTM (last twelve months) data, some of which involve non-GAAP financial measures 2Exclusive

of depreciation. 3 Revenue less operating costs divided by revenue. 4 OCF is operating income

before depreciation, amortization, goodwill and intangible asset impairments and restructuring and other charges and is a non-GAAP financial measure. 5 OCF divided by revenue and is a non-GAAP financial measure. 6 Capex defined as

purchase of fixed and intangible assets, which is a GAAP financial measure 7 Free Cash Flow (FCF) is operating income before depreciation, amortization, goodwill and intangible asset impairments and restructuring and other charges

(OCF) reduced by purchase of fixed and intangible assets and net interest expense and is a non-GAAP financial measure. See Appendices for reconciliations of non-GAAP financial measures to their nearest GAAP equivalents.

before depreciation, amortization, goodwill and intangible asset impairments and restructuring and other charges and is a non-GAAP financial measure. 5 OCF divided by revenue and is a non-GAAP financial measure. 6 Capex defined as

purchase of fixed and intangible assets, which is a GAAP financial measure 7 Free Cash Flow (FCF) is operating income before depreciation, amortization, goodwill and intangible asset impairments and restructuring and other charges

(OCF) reduced by purchase of fixed and intangible assets and net interest expense and is a non-GAAP financial measure. See Appendices for reconciliations of non-GAAP financial measures to their nearest GAAP equivalents.

OCF Margin(5)

OCF(4)

SG&A

Operating costs(2)

Revenue

Gross Margin(3)

35.7%

334

197

405

936

Q2-09

56.7%

85

33.3%

312

210

414

936

Q1-09

55.8%

62

35.5%

334

209

397

940

(£m)

Q2-08

57.8%

111

Free Cash Flow(7)

34.5%

1,302

828

1,647

3,777

FY-08

56.4%

351

34.3%

1,290

823

1,648

3,761

LTM

Jun-09(1)

Jun-09(1)

56.2%

306

Capex(6)

148

144

108

478

539

(adjusted)

(adjusted)

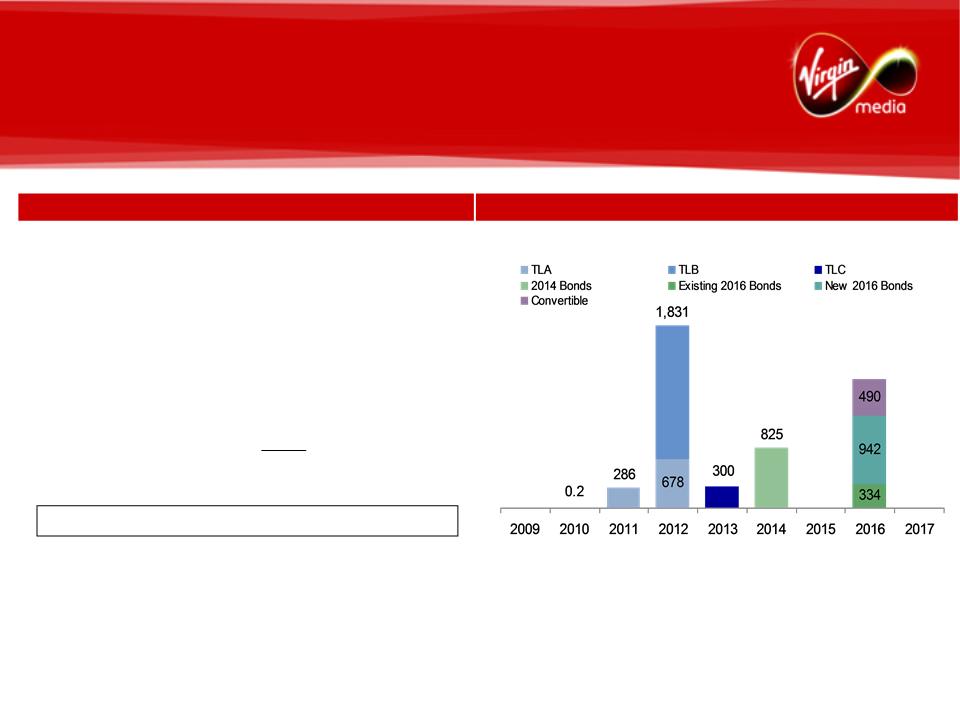

Proactive management of our debt

Note: The repayment schedule is based on spot rates as at end Q2-09 of £/$1.6452 and £/€1.1734

• Stable outlooks from all rating agencies: Ba3 (Moody’s), B+ (S&P), BB- (Fitch)

• Recent refinancing pushes out near-term maturities and improves financial flexibility

• Average cost of debt pro forma for recent bond issue is 7.1%

17

Repayment schedule after issue of 2016 bonds in July (£m)

Voluntary prepayment 120 Sep-06

TL A repayment 863 Apr-07

Excess cashflow 74 May-07

Voluntary prepayment 200 Dec-07

Convertible/cash on hand 504 Apr-08

Bank amendment - Nov-08

Voluntary prepayment 300 Dec-08

New 2016 Bonds/cash on hand 1,012 Jun/Jul-09

3,073

New TL B raised (890) Apr-07

Net bank prepayments 2,183

Bank prepayment Amount (£m) Date

18

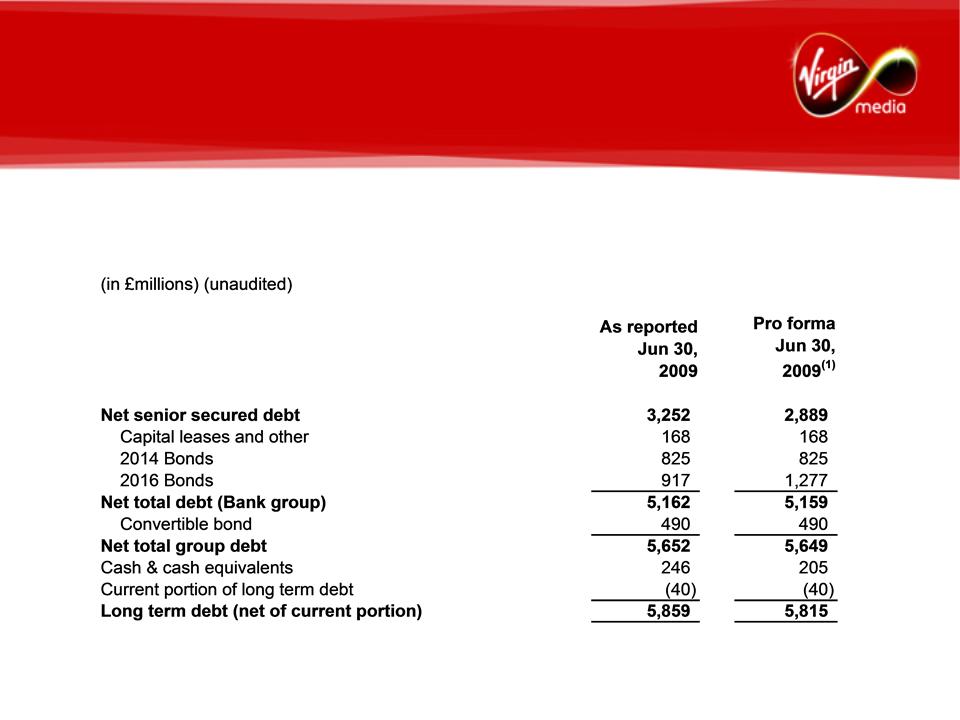

VMED Pro forma capitalisation

|

|

Size (£m)(1) |

LQA leverage multiple(2) |

Maturity |

Credit rating |

|

TL A-A1 |

286 |

|

Mar-11 |

Ba2/BB |

|

TL A2-A3 |

678 |

|

Jun-12 |

Ba2/BB |

|

TL B1-B12 |

1,831 |

|

Sep-12 |

Ba2/BB |

|

TLC |

300 |

|

Mar-13 |

B1/BB- |

|

Senior secured debt(3) |

3,094 |

2.3x |

|

|

|

Cash |

(205) |

(0.2x) |

|

|

|

Net senior secured debt(4) |

2,889 |

2.2x |

|

|

|

Capital leases and other |

168 |

|

|

|

|

2014 Senior notes |

825 |

0.6x |

Apr-14 |

B2/B |

|

2016 Senior notes |

1,277 |

1.0x |

Aug-16 |

B2/B |

|

Net total debt (Bank group)(4) |

5,159 |

3.9x |

|

|

|

Convertible bond |

490 |

0.4x |

Nov-16 |

B- |

|

Net total group debt(4) |

5,649 |

4.2x |

|

|

1 Pro forma for the $600m 2016 senior notes offering in Jul-09 and subsequent prepayment of bank debt using the proceeds together with cash on hand. The exchange rates used

are as at end Q2-09 and were £/$1.6452 & £/ €1.1734

2 LQA leverage multiple, as shown, is a ratio calculated by dividing the relevant debt measure by the last quarter annualised (LQA) OCF. LQA OCF as shown is OCF for Q2 2009 multiplied

by four. LQA leverage multiple and OCF are non-

GAAP financial measures. See the Appendices for reconciliations of non-GAAP financial measures to their nearest GAAP equivalents

GAAP financial measures. See the Appendices for reconciliations of non-GAAP financial measures to their nearest GAAP equivalents

3 Excludes £27.7m revolving credit facility due Mar-11 and £72.3m revolving credit facility due Jun-12

4 Net senior secured debt, Net total debt (Bank group) and Net total group debt are non-GAAP financial measures. See the Appendices for reconciliations of non-GAAP financial

measures to their nearest GAAP equivalents

Deleveraging / refinancing strategy

• Our refinancing strategy envisions further reductions to the size of the senior credit

facilities, possible further diversification of funding sources to include senior secured

notes, extension of existing senior note maturities, and the ultimate refinancing of the

senior credit facility well in advance of 2012 maturities

facilities, possible further diversification of funding sources to include senior secured

notes, extension of existing senior note maturities, and the ultimate refinancing of the

senior credit facility well in advance of 2012 maturities

• Key steps of our refinancing strategy:

– Oct/Nov 2008: Bank amendment to extend SFA

maturities by ca. 1 year

– May/Jul 2009: $1.6bn senior note issuances

to reduce SFA

– Oct 2009: Bank amendment to allow for further

SFA reductions through the

issuance of senior secured bonds

issuance of senior secured bonds

– Through 2010: Address 2014 notes

– 2010/11: Full refinancing of SFA

19

Rationale for amendment

• No requirement nor request for covenant/margin relief, nor reduction/deferral of

amortisation

amortisation

• Seek to remain proactive, and ensure comprehensive suite of options to continue strong

track-record in optimisation of long-term capital structure

track-record in optimisation of long-term capital structure

– Potentially access senior secured bond market

in cost-effective fashion, thus

reducing quantum of bank debt refinancing required

reducing quantum of bank debt refinancing required

– Facilitate smoothing of amortisation profile

– Enhance swap capacity, to optimise all-in

cost of hedged debt

20

21

Amendment request

22

Summary of requests/timing

• Virgin Media is seeking the consent of its senior lenders to:

A. Allow the issuance of senior secured bonds (“SSBs”) pari

passu to SFA debt

– 100% of the net proceeds raised from SSBs must

be used to prepay SFA debt

– Bullet maturity no earlier than March 2014

B. Update the hedging related provisions in the intercreditor

agreements to bring

them in line with current market standard and hedge counterparty expectations

them in line with current market standard and hedge counterparty expectations

C. Make certain clarifying and technical amendments

• All amendments require the consent of majority senior lenders (66 2/3%)

– Amendment is supported by the Company’s

top 10 relationship banks

• Consenting lenders receive a 25bps amendment fee if they respond by 30 October

2009

2009

23

Amendment timetable

|

Date |

Description |

|

20 October |

Lender conference call |

|

21 October |

Upload draft documentation to Intralinks |

|

30 October |

Final deadline for lender response |

|

2 November |

Amendment becomes effective |

|

5 November |

Agent pays amendment fees to consenting lenders |

19

1

5

26

15

16

17

18

14

13

22

23

24

25

21

20

29

28

27

8

9

10

11

7

6

2

3

4

30

31

October

S

W

T

F

S

T

M

12

26

November

S

W

T

F

S

T

M

2

9

23

12

13

14

15

10

19

20

21

22

18

17

25

24

5

6

7

8

4

3

1

16

27

28

29

30

11

Public holidays

24

Q&A

25

Appendices

Non-GAAP measures

Virgin Media uses non-GAAP financial measures with a view to providing investors with a better understanding of the

operating results and underlying trends to measure past and future performance and liquidity.

operating results and underlying trends to measure past and future performance and liquidity.

We evaluate operating performance based on several non-GAAP financial measures, including (i) operating income

before depreciation, amortization, goodwill and intangible asset impairments and restructuring and other charges

(OCF), (ii) net total group debt, which we also refer to as net debt, and (iii) OCF less purchases of fixed and intangible

assets and net interest expense (FCF or Free Cash Flow), as we believe these are important measures of the

operational strength of our business and our liquidity. Since these measures are not calculated in accordance with

GAAP, they should not be considered as substitutes for operating income (loss), long-term debt (net of current portion),

and net cash provided by operating activities, respectively.

before depreciation, amortization, goodwill and intangible asset impairments and restructuring and other charges

(OCF), (ii) net total group debt, which we also refer to as net debt, and (iii) OCF less purchases of fixed and intangible

assets and net interest expense (FCF or Free Cash Flow), as we believe these are important measures of the

operational strength of our business and our liquidity. Since these measures are not calculated in accordance with

GAAP, they should not be considered as substitutes for operating income (loss), long-term debt (net of current portion),

and net cash provided by operating activities, respectively.

This presentation also includes, as additional non-GAAP financial measures (i) net senior secured debt, (ii) net total

debt (Bank group), and (iii) net total group debt because we believe that these measures potentially are of interest to

our senior lenders in assessing our financing obligations. Since these measures are not calculated in accordance with

GAAP they should not be considered as a substitute for long-term debt (net of current portion).

debt (Bank group), and (iii) net total group debt because we believe that these measures potentially are of interest to

our senior lenders in assessing our financing obligations. Since these measures are not calculated in accordance with

GAAP they should not be considered as a substitute for long-term debt (net of current portion).

This presentation further includes another non-GAAP financial measure, net LQA leverage multiple, which is the ratio

of the relevant debt measure to the last quarter annualised (LQA) OCF. We believe that this ratio is potentially of

interest to our senior lenders in assessing our cash flows and liquidity. The amounts used in this calculation should not

be considered a substitute for measures calculated in accordance with GAAP, as discussed above.

of the relevant debt measure to the last quarter annualised (LQA) OCF. We believe that this ratio is potentially of

interest to our senior lenders in assessing our cash flows and liquidity. The amounts used in this calculation should not

be considered a substitute for measures calculated in accordance with GAAP, as discussed above.

26

27

Operating income before depreciation, amortization,

goodwill and intangible asset impairments and

restructuring and other charges (OCF)

goodwill and intangible asset impairments and

restructuring and other charges (OCF)

Operating income before depreciation, amortization, goodwill and intangible asset impairments and

restructuring and other charges, which we refer to as OCF, is not a financial measure recognized

under GAAP. OCF represents our operating income before depreciation, amortization, goodwill and

intangible asset impairments and restructuring and other charges. Our management, including our

chief executive officer, consider OCF as an important indicator of our operational strength and

performance. OCF excludes the impact of costs and expenses that do not directly affect our cash

flows. Restructuring and other charges are also excluded from OCF as management believes they are

not characteristic of our underlying business operations. OCF is most directly comparable to the

GAAP financial measure operating income (loss). Some of the significant limitations associated with

the use of OCF as compared to operating income (loss) are that OCF does not consider the amount of

required reinvestment in depreciable fixed assets and ignores the impact on our results of operations

of items that management believes are not characteristic of our underlying business operations.

restructuring and other charges, which we refer to as OCF, is not a financial measure recognized

under GAAP. OCF represents our operating income before depreciation, amortization, goodwill and

intangible asset impairments and restructuring and other charges. Our management, including our

chief executive officer, consider OCF as an important indicator of our operational strength and

performance. OCF excludes the impact of costs and expenses that do not directly affect our cash

flows. Restructuring and other charges are also excluded from OCF as management believes they are

not characteristic of our underlying business operations. OCF is most directly comparable to the

GAAP financial measure operating income (loss). Some of the significant limitations associated with

the use of OCF as compared to operating income (loss) are that OCF does not consider the amount of

required reinvestment in depreciable fixed assets and ignores the impact on our results of operations

of items that management believes are not characteristic of our underlying business operations.

We believe OCF is helpful for understanding our performance and assessing our prospects for the

future, and that it provides useful supplemental information to investors. In particular, this non-GAAP

financial measure reflects an additional way of viewing aspects of our operations that, when viewed

with our GAAP results and the reconciliation to operating income (loss) shown below, provides a more

complete understanding of factors and trends affecting our business. Because non-GAAP financial

measures are not standardized, it may not be possible to compare our OCF with other companies'

non-GAAP financial measures that have the same or similar names.

future, and that it provides useful supplemental information to investors. In particular, this non-GAAP

financial measure reflects an additional way of viewing aspects of our operations that, when viewed

with our GAAP results and the reconciliation to operating income (loss) shown below, provides a more

complete understanding of factors and trends affecting our business. Because non-GAAP financial

measures are not standardized, it may not be possible to compare our OCF with other companies'

non-GAAP financial measures that have the same or similar names.

28

Net total group debt, Net senior secured

debt and Net total debt (Bank group)

debt and Net total debt (Bank group)

Net total group debt is defined as long-term debt inclusive of current portion, less cash and cash equivalents. Net

senior secured debt is defined as our long-term debt related to our senior credit facility inclusive of current portion, less

cash and cash equivalents. Net total debt (Bank group) is defined as our long term debt related to our senior credit

facility inclusive of current portion, senior notes, capital leases and other obligations, less cash and cash equivalents.

Our management, including our chief operating decision-maker, consider these measures as potentially of interest to

our senior lenders in assessing our financing obligations.

senior secured debt is defined as our long-term debt related to our senior credit facility inclusive of current portion, less

cash and cash equivalents. Net total debt (Bank group) is defined as our long term debt related to our senior credit

facility inclusive of current portion, senior notes, capital leases and other obligations, less cash and cash equivalents.

Our management, including our chief operating decision-maker, consider these measures as potentially of interest to

our senior lenders in assessing our financing obligations.

Net total group debt, net senior secured debt and net total debt (Bank group) are not financial measures recognised

under GAAP. These measures are most directly comparable to the GAAP financial measure, long term debt, net of

current portion. The significant limitation associated with the use of net total group debt as compared to long term debt,

net of current portion is that net total group debt includes the current portion of long term debt. The significant limitation

associated with the use of net senior secured debt as compared to long term debt, net of current portion is that net

senior secured debt includes the current portion of debt and excludes our subordinated debt obligations. The significant

limitation associated with the use of net total debt (Bank group) as compared to long term debt, net of current portion is

that net total debt (Bank group) includes the current portion of debt and excludes our convertible debt obligations.

These measures also assume that all of the cash and cash equivalents are available to service debt.

under GAAP. These measures are most directly comparable to the GAAP financial measure, long term debt, net of

current portion. The significant limitation associated with the use of net total group debt as compared to long term debt,

net of current portion is that net total group debt includes the current portion of long term debt. The significant limitation

associated with the use of net senior secured debt as compared to long term debt, net of current portion is that net

senior secured debt includes the current portion of debt and excludes our subordinated debt obligations. The significant

limitation associated with the use of net total debt (Bank group) as compared to long term debt, net of current portion is

that net total debt (Bank group) includes the current portion of debt and excludes our convertible debt obligations.

These measures also assume that all of the cash and cash equivalents are available to service debt.

We believe these measures may be helpful for understanding our debt funding obligations and provide useful

supplemental information to senior lenders. Because non-GAAP financial measures are not standardised, it may not be

possible to compare net total group debt, net senior secured debt and net total debt (Bank group) with other

companies' non-GAAP financial measures that have the same or similar names. The presentation of this supplemental

information is not meant to be considered in isolation or as a substitute for long term debt, net of current portion or

other measures of financial performance or liquidity reported in accordance with GAAP.

supplemental information to senior lenders. Because non-GAAP financial measures are not standardised, it may not be

possible to compare net total group debt, net senior secured debt and net total debt (Bank group) with other

companies' non-GAAP financial measures that have the same or similar names. The presentation of this supplemental

information is not meant to be considered in isolation or as a substitute for long term debt, net of current portion or

other measures of financial performance or liquidity reported in accordance with GAAP.

Free Cash Flow

We define Free Cash Flow (FCF) as operating income before depreciation, amortization, goodwill and

intangible asset impairments and restructuring and other charges (OCF) reduced by purchase of fixed and

intangible assets, as reported in our statements of cash flows, and net interest expense, as reported in our

statements of operations. Our definition of FCF excludes the impact of working capital fluctuations and

restructuring costs as defined by FAS 146. FCF is a non-GAAP financial measure. We believe the most

directly comparable financial measure recognized under GAAP is net cash provided by operating activities.

intangible asset impairments and restructuring and other charges (OCF) reduced by purchase of fixed and

intangible assets, as reported in our statements of cash flows, and net interest expense, as reported in our

statements of operations. Our definition of FCF excludes the impact of working capital fluctuations and

restructuring costs as defined by FAS 146. FCF is a non-GAAP financial measure. We believe the most

directly comparable financial measure recognized under GAAP is net cash provided by operating activities.

Our management, including our chief executive officer, consider FCF as a helpful measure in assessing our

liquidity and prospects for the future. We also believe FCF is useful to investors as a basis for comparing our

performance and coverage ratios with other companies in our industry. In particular, this non-GAAP financial

measure reflects an additional way of viewing aspects of our operations that, when viewed with our GAAP

results and the reconciliation to net cash provided by operating activities shown below, provides a more

complete understanding of factors and trends affecting our business. FCF should not be understood to

represent our ability to fund discretionary amounts, as we have various contractual obligations which are not

deducted to arrive at FCF. Because non-GAAP financial measures are not standardized, it may not be

possible to compare our FCF with other companies’ non-GAAP financial measures that have the same or

similar names.

liquidity and prospects for the future. We also believe FCF is useful to investors as a basis for comparing our

performance and coverage ratios with other companies in our industry. In particular, this non-GAAP financial

measure reflects an additional way of viewing aspects of our operations that, when viewed with our GAAP

results and the reconciliation to net cash provided by operating activities shown below, provides a more

complete understanding of factors and trends affecting our business. FCF should not be understood to

represent our ability to fund discretionary amounts, as we have various contractual obligations which are not

deducted to arrive at FCF. Because non-GAAP financial measures are not standardized, it may not be

possible to compare our FCF with other companies’ non-GAAP financial measures that have the same or

similar names.

The presentation of this supplemental information is not meant to be considered in isolation or as a substitute

for net cash provided by operating activities, or other measures of financial performance or liquidity reported in

accordance with GAAP.

for net cash provided by operating activities, or other measures of financial performance or liquidity reported in

accordance with GAAP.

29

30

Reconciliation of operating income before depreciation, amortization, goodwill

and intangible asset impairments and restructuring and other charges (OCF) to

GAAP operating income (loss)

and intangible asset impairments and restructuring and other charges (OCF) to

GAAP operating income (loss)

(1) LTM or last twelve months information has been derived from previously reported results.

OCF - Non-GAAP Reconciliation

31

Last Twelve Months (LTM) calculation

as at June 30, 2009

as at June 30, 2009

Note: LTM information has been derived from previously reported annual and quarterly results. For further details regarding these results, see the information on our Earnings Releases

filed on Form 8-K and on Form 10-Q on August 7, 2009

filed on Form 8-K and on Form 10-Q on August 7, 2009

32

Net total group debt, Net senior secured debt and

Net total debt (Bank group) - Non-GAAP

reconciliations

Net total debt (Bank group) - Non-GAAP

reconciliations

Reconciliation of net total group debt, net senior secured debt and net total debt

(bank group) to long term debt, net of current portion

(bank group) to long term debt, net of current portion

(1) Pro forma for the $600m 2016 senior notes offering in Jul-09 and subsequent prepayment of bank debt using the proceeds together with cash on hand. The exchange rates used are as

at end Q2-09 and were £/$1.6452 & £/ €1.1734

at end Q2-09 and were £/$1.6452 & £/ €1.1734

33

LQA leverage multiple - Non-GAAP

reconciliation

reconciliation

(1) Pro forma for the $600m 2016 senior notes offering in Jul-09 and subsequent prepayment of bank debt using the proceeds together with cash on hand. The exchange rates used are as

at end Q2-09 and were £/$1.6452 & £/ €1.1734

at end Q2-09 and were £/$1.6452 & £/ €1.1734

34

FCF Calculation and Non-GAAP

reconciliation

reconciliation

(1) LTM or last twelve months information has been derived from previously reported results.

Note: The line descriptions above are derived from our previously reported results. Non-cash interest includes non-cash interest and amortization of original issue discount and deferred

financing costs from our statements of cash flows. Share of net income of affiliates includes income from equity accounted investments, net of dividends received from our statements of

cash flows and share of income from equity investments from our statements of operations. Realized foreign exchange (losses)/gains includes unrealized foreign currency losses (gains)

from our statements of cash flows and foreign currency (losses) gains from our statements of operations. Realized gains/(losses) on derivatives includes unrealized (gains) losses on

derivative instruments from our statements of cash flows and gains (losses) on derivative instruments from our statements of operations. Income taxes includes income taxes from our

statements of cash flows and income tax benefit (expense) from our statements of operations.

financing costs from our statements of cash flows. Share of net income of affiliates includes income from equity accounted investments, net of dividends received from our statements of

cash flows and share of income from equity investments from our statements of operations. Realized foreign exchange (losses)/gains includes unrealized foreign currency losses (gains)

from our statements of cash flows and foreign currency (losses) gains from our statements of operations. Realized gains/(losses) on derivatives includes unrealized (gains) losses on

derivative instruments from our statements of cash flows and gains (losses) on derivative instruments from our statements of operations. Income taxes includes income taxes from our

statements of cash flows and income tax benefit (expense) from our statements of operations.

35

Last Twelve Months (LTM)

June 30, 2009

June 30, 2009

Note: LTM information has been derived from previously reported annual and quarterly results. For further details regarding these results, see the information on our Earnings Releases

filed on Form 8-K and on Form 10-Q on August 7, 2009

filed on Form 8-K and on Form 10-Q on August 7, 2009